Malaysia

CIMB invests $23.85m to finance renewable energy for Malaysian SMEs

It will provide SMEs 100% funds to install solar photovoltaic systems.

CIMB invests $23.85m to finance renewable energy for Malaysian SMEs

It will provide SMEs 100% funds to install solar photovoltaic systems.

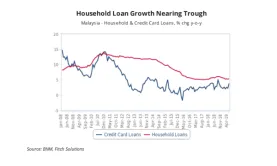

Malaysian banks hit by tepid loan growth

Loans grew by just 3.9% in August and loan applications shrunk 3.7%.

Will property stress threaten to undo Malaysia's banking resilience?

Unsold housing stock may pressure asset quality.

Alliance Bank, CGC grants up to $240,000 to Malaysian SMEs

The portfolio guarantee agreement has a tranche size of $72.01m.

Malaysian bank earnings up 5% in Q2

Investment and trading income drove quarterly profit gains.

How RHB Bank aims to plug Malaysia's $20b SME funding gap

The bank aims to extend $7.5b in new and additional loans for SMEs by 2021.

How banks in Malaysia are keeping up with the digital shift

Striking the balance between mobile and online offerings as well as physical branches is key.

Malaysian e-payment transactions nearly tripled in 2018

It hit 125 transactions per capita last year.

Malaysian bank earnings growth to slow to 1% as loans falter

Loans continued to trend downwards in June, falling 4.2%.

Malaysia rides on Asia's virtual banking drive

Potential web-only players could target both the unbanked and the affluent segment.

Malaysian banks' core net profit fell 2% in Q1

AMMB’s net profit crashed 36%.

Chart of the Week: Can households buoy Malaysia banks' loan growth?

The sector makes up 5.7.8% of the total loans.

Malaysia and Indonesia go head-to-head on Islamic banking digitisation

Malaysian Islamic banks could lean on their parent groups cashing in to boost digital drive.

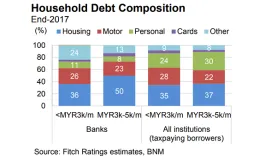

Malaysian banks bear weight of $234b household debt burden

Lower income borrowers account for 37% of household loans.

Malaysian banks lead Southeast Asia in board diversity

Women make up over a third of boards compared to only 9% in the Philippines.

TransferWise to launch remittance services in Malaysia

It will also enable customers to access eKYC checks. UK-based fintech firm TransferWise obtained its remittance license in Malaysia which will allow the firm to launch remittances from its fourth Asian location. Previously, TransferWise was only able to enable customers to send money to but not from Malaysia. Apart from this, the license will also allow TransferWise customers in Malaysia to access eKYC (electronic Know Your Customer) checks, instead of having to fulfil KYC requirements face-to-face. “That means customers can open an account by simply submitting documents online, via the TransferWise app or website, without having to travel to a physical branch. This is similar to the experience new Singapore customers currently get,” the firm said in an announcement. TransferWise currently sends money from 43 countries, of which four are in Asia - namely Singapore, Japan and Hong Kong and Malaysia. Meanwhile, it allows money to be sent to 71 countries. “With an online banking penetration rate of over 85% as well as high smartphone adoption, Malaysia is well poised to become an important hub for fintechs in the region,” Malaysian minister of communications and multimedia Gobindh Singh Deo said. Launched in 2011 and headquartered in London, TransferWise handles $5.12b of cross-border transfers every month for its 5 million customers.

Malaysian banks earnings slipped 0.5% in Q1

The sector’s pre-provision operating profit is at its lowest since Q1 2017.

Advertise

Advertise