China

China's banking assets up by 19%

Assets of China's banking sector grew by 19.1 percent in 2011 to 105.8 trillion yuan or 16.8 trillion U.S. dollars.

China's banking assets up by 19%

Assets of China's banking sector grew by 19.1 percent in 2011 to 105.8 trillion yuan or 16.8 trillion U.S. dollars.

China liberalizes interest rates

China raised the ceiling on deposit rates to 110 percent of the benchmark from 100 percent. This is in addition to the parallel 25-basis-point cut in the benchmark deposit and loan rates.

Dubai bank expanding Asian operations

State-owned Noor Islamic Bank seeks more business in Singapore and Malaysia to benefit from growth in Southeast Asia.

UAE banks seek more business in China

Two of the largest banks in the United Arab Emirates will set up offices in China to boost trade between both nations.

Basel III will have to wait

China will delay the implementation of tough new bank rules until next year.

Credit slowdown lingers in China

China's lending and deposit rates remain stable, while outstanding loans still show a downtrend.

CBRC worried over Chinese banks' risky behaviors

Chinese banks are urged to focus on raising capital than taking on more risks.

China’s banking "reforms" an illusion

China’s heavily hyped banking reforms look more like a gimmick than the real deal.

Audit uncovers rule violations by ICBC, Citic

ICBC and the Citic Group were found to have violated several financial regulations in a routine audit by the National Audit Office.

Russian banks to forge closer ties with Chinese partners

Russian banks expect to sign agreements with Chinese partners on financing several projects in Russia during President Vladimir Putin's visit to China next week.

HSBC China to be among the first for direct RMB-Yen trading

HSBC China will be among first market makers for the direct trading of the renminbi and yen after it was approved by China's central bank.

JP Morgan Chase invests heavily in China

JPMorgan Chase & Co has raised its capital of its Chinese division to over US$1 billion to exploit broader opportunities arising from a further liberalization of China’s banking sector.

Direct yen-yuan trading to begin this week

China has taken a key step towards making the yuan or renminbi a truly global currency.

Loan mix in China may shift to more mid- and long-term loans

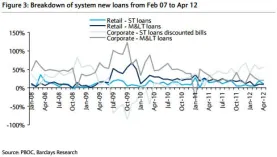

So far loan growth year-todate was mainly driven by short-term corporate loans and discounted bills, says Barclays Research.

Chinese banks finally open up to private capital

China’s decelerating economy has compelled China’s banks to accept private investments to generate funds for lending to small and medium enterprises.

Chinese businesses shun bank loans as economy worsens

China’s banking sector is lending less and less because of the spreading economic slowdown.

Chinese banks sell more forex than it purchased

Chinese banks bought US$110.2 billion on behalf of clients in April and sold US$113.9 billion U.S. dollars, resulting in a net sale of 3.7 billion U.S. dollars.

Advertise

Advertise