China

Are Chinese banks ill-equipped to acquire and run Euro banks?

The best that predatory Chinese banks could do is take over a struggling European bank and leave the management in place.

Are Chinese banks ill-equipped to acquire and run Euro banks?

The best that predatory Chinese banks could do is take over a struggling European bank and leave the management in place.

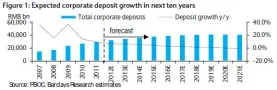

See how China's corporate deposit growth will deteriorate in 10 years

It is expected to decline to a negative growth in 2021.

China Merchants Bank's NPLs up 10.2% for the successive third quarter

And total deposits fell by 1.8%.

China CITIC Bank's net profit down 27% to CNY 7.9b in 3Q12

But underlying trends remain good.

China Construction Bank's sluggish net fee income fell by 2% in 3Q12

But CCB's net profit increased 12% to RMB51.9bn.

Minsheng Bank's MSE loan growth rebounds by RMB29.9bn

The momentum is expected to continue into 4Q12.

China's depressing corporate deposits growth to eventually close to zero

From 18% in 2002 to 9% in Sep 2012 to -1% in 2021.

Agricultural Bank of China ups net profit by 19.2%

A net profit of US$19.06 billion.

Ping An, Huaxia banks see profits slow in Q3

It still increased.

Bank of China's net profit up 10% to CNY106.4b in 9M12

But profit in 3Q12 was flat at CNY34.8b.

China banks' loan growth on track to meet the RMB8.5tn target for 2012

Total new RMB loans reached RMB6.72tn in the first nine months of 2012.

Chinese banks financing more foreign trade

Outstanding trade financing between banks and China’s exporters and importers amounted to US$469 billion in September, 34% higher year-on-year.

GRG Global Customer Exchange unveils Video Teller Machine demonstration

ATM convenience and branch complexity rolled into one.

Will slashing shareholder dividends improve the Big Four's profitability?

Reports say China's Big Four banks may reduce their dividend payout ratios by five percentage points to 35%.

CDB makes record loan for poverty relief

China Development Bank has agreed to provide a record US$160 million.

The synergy between trade finance and trade credit insurance

As I scanned my Insurance Day newsletter in London the day I wrote this article, three articles caught my eye “Market Update: trade credit claims rise in 2012 following 30% jump in 2011;” “Trade credit: uncollectable debts rising in North America;” and, then, “Credit insurers call for banks to ‘behave as they should to end financing gridlock [the International Credit Insurance & Surety Association] points at banking sector’s failure to extend credit as major obstacle to economic growth.” Despite the incongruity these headlines demonstrate the synergy between trade finance and trade credit insurance (TCI).

3 most in demand skill in Asian banking and finance

Asia’s banking and finance sector is still actively hiring – evidence that particular skills are in demand in the region despite the current global economic climate. Christine Wright, Operations Director for Hays in Asia, discusses the trends and current opportunities across the region from the latest Hays Quarterly Report.

Advertise

Advertise