China

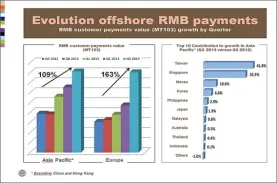

Here's proof that RMB customer payments in Europe rocketed 163%

Will Europe overtake Asia in RMB trade settlement?

CCB out to buy Brazilian bank

Is currently in talks with Banco Industrial e Comercial SA.

China launches online credit information service

Service began Oct. 28. Chinese living in nine provincial-level regions (including Beijing and Guangdong) can look up their personal credit reports using an online inquiry service. The new platform is expected to draw public attention to personal credit records and help make credit management a part of people's daily routine. It is another form of credit tracking and will be available to the entire population in the first half of 2014, said the People's Bank of China. PBOC began building its database of credit information in 2006. The database collected information on 820 million individuals, of which 290 million had personal credit files. This database served as a yardstick for financial institutions to measure an individual's trustworthiness, especially when providing a loan. The China Banking Association said China’s financial institutions issued 330 million credit cards by the end of 2012, with annual trading of US$1.63 trillion. PBOC said banks' outstanding loans for home purchases stood at US$1.4 trillion as of end September.

China Exim Bank opens branch in Paris

Branch is first overseas by this state-owned bank. Li Ruogu, president of the Export-Import Bank of China, said the creation of the Paris branch gives the bank a financial services platform closer to its market and clients in Europe. He noted the branch would benefit Sino-French and Sino-European economic and commercial cooperation. Chinese government sources said the establishment of the Paris branch means that Chinese banks think highly of the strategic significance of Paris with its role as an international financial center, and have full confidence in Sino-French cooperation in economic and commercial fields. Founded in 1994, the Export-Import Bank of China facilitates the export and import of Chinese products; assists Chinese companies with comparative advantages and promotes international economic cooperation and trade.

Asian countries plan tougher oversight on western credit rating agencies

Meet in Tokyo to consider slashing reliance on raters. Asian countries discussed efforts to decrease their "mechanistic" reliance on western credit ratings and to strengthen oversight of rating agencies during a meeting of the Financial Stability Board (FSB) Regional Consultative Group for Asia. Since the Great Recession of 2008, there has been significant discussion on the key role of western credit rating agencies in triggering the crisis. Some countries strongly objected to the sovereign ratings assigned for them. Members of the Regional Consultative Group for Asia include Australia, Cambodia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, New Zealand, Pakistan, Philippines, Singapore, Sri Lanka, Thailand and Vietnam.

China will expand pilot consumer finance program

Ten more cities will be added to program.

PBOC again floods banking system with cash

This time to the tune of US$2.1 billion.

China Citic Bank reports 33% jump in net profits

This due to higher net interest income, fees and commissions.

Deutsche Bank receives inter-bank bond settlement license from China

Will enable inter-bank bond trading service in China.

CCB profit growth slows on mounting bad loans

Has had to pay more to attract deposits.

UBS now largest private bank in Asia-Pacific

Indicates UBS’ resurgence following recent scandals.

China launches new benchmark lending rate

Part of stepped-up market reforms.

HSBC China with new tax payment service

First of its kind among all foreign banks in Shanghai.

Wenzhou to pilot local privately owned banks

Trials need more policy support, however.

AgBank dumping bad assets

Has highest NPL ratio among all 17 publicly traded banks.

PBOC signs MoU with FDIC

Agreement covers technical assistance and other concerns.

Advertise

Advertise