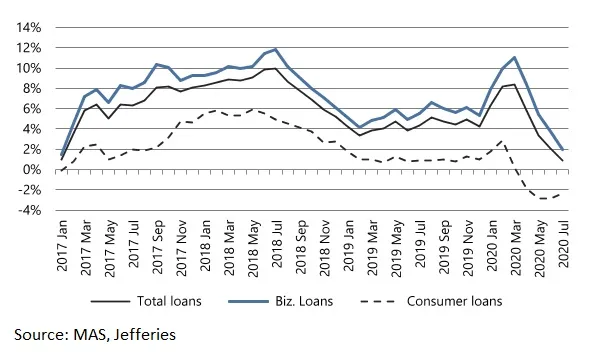

Chart of the Week: Singapore system loans up 0.9% in July

This was driven by a 1.9% growth in business loans.

Singapore's system loans rose 0.9% YoY in July, driven by a 1.9% growth in business loans, according to Jefferies Equity Research. This was offset by consumer loans shrinking 2.4% YoY over the same period.

Compared to May, system loans declined 1%, with business loans contracting 1.4% MoM whilst consumer loans dipped 0.4% MoM. This indicates a slowing pace of shrinkage of the consumer loan book, according to Krishna Guha, analyst at Jefferies.

“Business loans for construction, business services and to financial institutions continue to grow whilst within consumer lending, personal and credit card loans reversed the monthly declines since February this year. Mortgage book shrank at slower pace," noted Guha.

He added that consumer loans may begin to rise as property launches and resale volumes pick up. "In our view, as property launches and resale volumes pick up pace, equity market show signs of optimism and advertisements for unsecured personal loans overflow; consumer loan book may inflect."

Advertise

Advertise