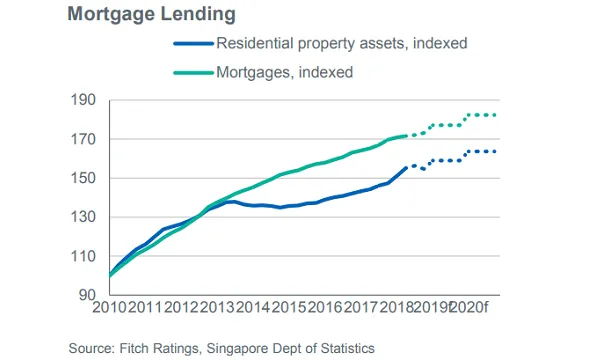

Chart of the Week: Singapore mortgage loans to grow 3% in 2019

The cooling measures will temper borrowing activities.

The mortgage arms of Singapore banks could expect moderate expansion of 3% in both 2019 and 2020, according to Fitch Ratings, as lending softens due to slowing home prices, rising interest rates and property cooling measures.

"The agency expects owner-occupied home purchases to remain the main driver of mortgage loan growth," the ratings agency said in a report.

The subdued growth in home loans comes after the government imposed surprise cooling measures in July 2018 which saw the Additional Buyers' Stamp Duty raised by an additional 5-10pp and Loan-to-Value (LTV) limits tightened by 5bp.

Also read: Property curbs and trade war a double whammy for Singapore banks

The cooling measures did not have immediate negative impact on Singapore home loans on the back of previous approvals that banks drew down, according to a flash note by DBS, which suggested that the curbs will likely hit banks hard by 2019.

As mortgage rates rise, the non-performing loan (NPL) ratio of the housing segment is expected to rise from 0.4% in 2018 to 0.7% in 2020.

"The housing NPL ratio was 0.4% in 2Q18 and we expect it to rise only slightly to 0.55% in 2019 and 0.65% in 2020," the research firm added. "However, we expect any increase in delinquencies to be limited due to support from rising household incomes, a tight labour market and strong household balance sheets."

Advertise

Advertise