Chart of the Week: Half of Korean banks' loan quality imperiled by prolonged COVID-19 outbreak

This could impact the broad service and manufacturing sectors that make up about 58% of loans.

Korean commercial banks face higher credit costs and deteriorating loan quality if the coronavirus outbreak persists for longer than the near-term, reports Fitch Solutions.

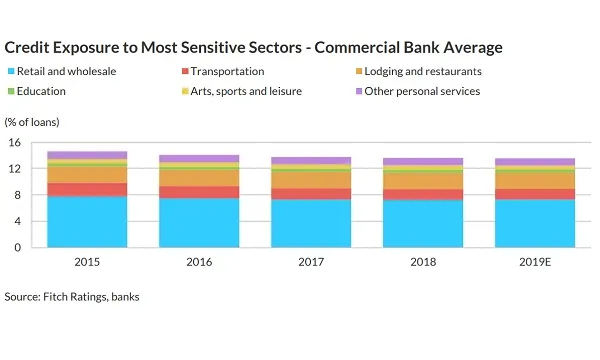

On average, about 14% of these banks’ total loans are exposed to the sectors that are first to be hit by the abrupt slowdown in consumer demand such as tourism, education, entertainment, transportation, and offline shopping.

A prolonged spread of the virus in the coming months could also lead to a sharp increase in credit costs in the broad service sector, which make up about one-third or 33% of the system’s total loans, but also the manufacturing sector, which make up a quarter or 25% of total loans.

“The rapid spread of COVID-19 in the recent months has introduced significant uncertainty to the performance of South Korea’s banks, at least in the short term. The impact on their credit profiles in the medium term depends not only on the severity and duration of what is now a global health emergency, but also on government responses,” the report read.

Coming into 2020, the overall loan quality of the commercial banks in aggregate was sound with an estimated precautionary-and-below loan ratio about 1.1% at end-2019, noted Fitch.

Assuming that a credit crunch does not develop and the epidemic subsides in the coming months, Korean banks with large national franchises and limited regional concentration are likely to record a broadly steady performance for the fiscal year.

These banks will be able to mitigate the downside risks due to their improved risk appetite over the last seven years. They will also be supported by the policy measures introduced to support a recovery, including the $10b supplementary budget by the government.

Additional support measures, including an expansionary monetary policy and counter-cyclical credit expansion through Korea's policy financial institutions, may alleviate the pressure on commercial banks, the report concluded.

Advertise

Advertise