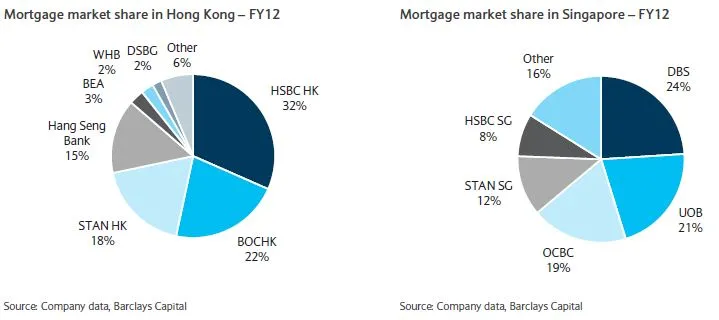

These graphs show the mortgage market share of banks in Hong Kong and Singapore

Find out which banks are more exposed to the impact of the property cooling measures.

According to Barclays, the largest mortgage players in Hong Kong and Singapore (HSBC, STAN, BOCHK, Hang Seng Bank, BEA, DBS, OCBC and UOB) together account for 80%+ market shares.

Here's more from Barclays:

Capital ratios reflect a bank’s solvency and resilience, but they depend heavily on the risk weightings of assets.

There has been increasing scrutiny by regulators and investors in the way certain banks calculate their RWAs (particularly the ones using the Basel II advanced IRB approach).

RWAs vary from bank to bank where different complex methodologies are used based on each bank’s internal model. A key input that is used to determine risk weightings – Probability of Default (PD) – can be highly subjective and open to interpretation.

The largest mortgage players in Hong Kong and Singapore (HSBC, STAN, BOCHK, Hang Seng Bank, BEA, DBS, OCBC and UOB) which together account for 80%+ market shares, use the IRB approach to determine their mortgage risk weightings.

The IRB approach relies on the banks own assessment of the probability of default (PD) and loss given default (LD) based on their historical experiences. Given the strong credit quality records in Hong Kong and Singapore, mortgage risk weightings are as low as 5% determined under the IRB approach.

The smaller banks, Wing Hang Bank and Dah Sing, still use the standardised approach in which a 35% risk weight is used on mortgage exposure.

Advertise

Advertise