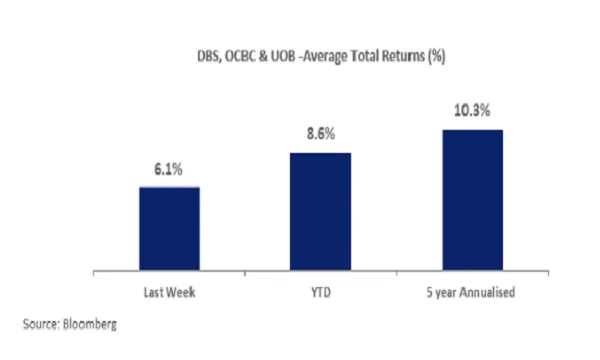

Singapore banks lead STI gains with 6.1% rally in April YTD

Their average 2019 YTD total return stands at 8.6%.

Singapore's three listed local banks, with a combined market capitalisation of $163b, led the Straits Times Index’s (STI) 3.4% gain during the first week of April, according to Singapore Exchange’s (SGX) market updates.

DBS, UOB and OCBC averaged a 6.1% gain, which has brought the average 2019 YTD total return of the three banks to 8.6% and their five-year average annualised total return to 10.3%.

Combined, the three banks reported total income (pre-allowances, expenses & taxes) of $32b for FY18, up 6.6% from $30b in FY17. According to SGX, DBS reported total income of $13.2b, whilst OCBC and UOB reported total income of $9.7b and $9.1b, respectively, in FY 2017.

“The average net interest margin (NIM) for the three banks in FY2018 was up 7 basis points (bps) from 1.72% in FY2017 to 1.79% in FY2018. The FY2016 NIM averaged 1.73% for the three banks,” SGX noted.

Combined, the quarterly net interest income for the three banks has gradually grown in recent years and has been consistently above $4b for each quarter since end-2014.

“Moreover, combined quarterly net interest income was above $5b for each quarter in FY2018. This has coincided with gradual increases of local interest rates as represented by the 1-month swap offer rate (SOR) and 3-month Singapore Interbank Offered Rate (SIBOR),” SGX added.

As of end-March, the average indicative dividend yield of the three banks stood at 4.2%, which has since retraced to 4% with the strong gains of the banks in the April month-to-date. At the end of March, the average yield of DBS, OCBC and UOB had ended each of the preceding six months above 4%.

“This was the lengthiest time in their recent trading history that the average dividend yield for the three banks had consistently held above 4% at month end,” SGX noted.

The three banks are expected to report their Q1 FY2019 results in early May, with UOB confirming it will release its earnings before trading on 3 May.

Advertise

Advertise