Japan announces US$128 billion stimulus

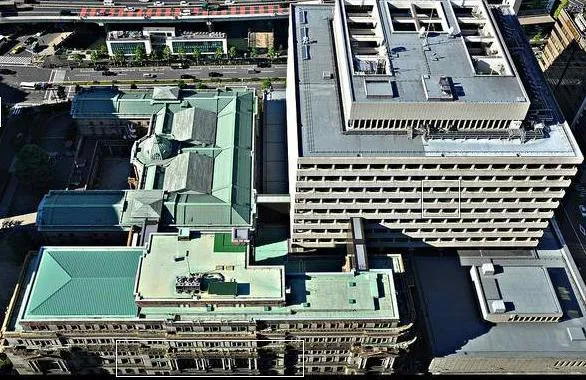

The Bank of Japan has extended its asset-purchasing scheme by US$128 billion to boost the moribund economy.

The central bank warned ". . . the pick-up in economic activity has come to a pause" in Japan due to the slowing overseas economies.

"There remains a high degree of uncertainty about the global economy, including the prospects for the European debt problem, the momentum toward recovery for the US economy."

The move will increase the bank's asset-buying program to US$1 trillion. The program is the main tool for monetary easing that provides liquidity to markets as the central bank purchases government and corporate bonds and commercial paper.

Pressure on the central bank to take additional easing steps had been increasing after the European and US central banks took action to support their economies beginning at the start of the month.

Two weeks ago, the European Central Bank announced a plan to buy sovereign debt to lower borrowing costs to weaker nations in the European Union. A week later the U.S. Federal Reserve unveiled an open ended bond-buying programme it said it would support until the U.S. economy recovered and unemployment fell.

Finance Minister Jun Azumi welcomed the central bank's decision, saying that the bank "took more action than we anticipated" and it would help to support the economy.

The central bank's announcement, however, immediately sent the yen tumbling against the dollar and euro while the Nikkei roared to a four-month high. The action by Japan's central bank came after a two-day meeting that also saw interest rates kept at record lows.

Advertise

Advertise