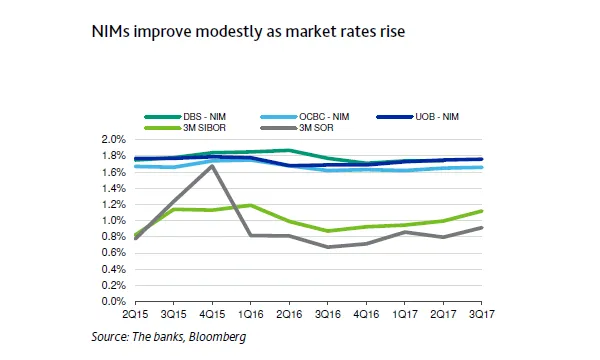

Chart of the Week: Singapore banks' NIMs improve modestly

Thanks to rising interest rates in Singapore and the US.

According to Moody's, OCBC and UOB reported stronger pre-provision and bottom-line profitability for the first nine months of 2017, while DBS's financial results were dampened by its accelerated recognition of NPLs and resultant large specific provisions. DBS's pre-provision income was also affected by lower trading gains compared to a year earlier.

Here's more from Moody's:

The three banks' recurring pre-provision income growth remains healthy, supported by continued growth in fee income from wealth management and bancassurance businesses, as well as a modest widening of NIM.

The three Singapore banks' NIMs will likely improve as interest rates in Singapore rise in tandem with rates in the US. According to the banks, local rates could reflect 40-60% of rate increases in the US.

DBS's credit costs will likely decline substantially in Q4 2017, because the bank has proactively downgraded a large amount of exposures in Q3 2017 ahead of the implementation of SFRS 109. We understand that UOB and OCBC have yet to decide on the treatment of excess general provisions. Credit costs in 2018 will decline from 2017 levels, because we expect that the bulk of oil and gas provisions will be made in 2017.

OCBC and UOB maintained their NPL coverage ratios above 100% in Q3 2017, while the ratio for DBS fell to 83%. According to DBS, its unsecured oil and gas services NPLs are provisioned at 100%, implying there is limited room for additional provisions for these unsecured loans.

Advertise

Advertise