How blockchain is unchained in Singapore

Check out the latest developments around blockchain in Singapore.

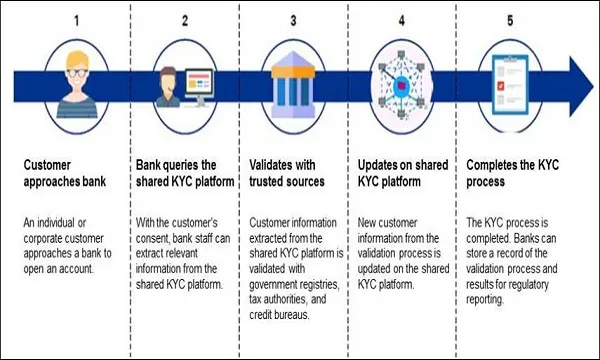

In October 2017, OCBC, HSBC, Mitsubishi UFJ Financial Group, and Singapore’s Infocomm Media Development Authority broke new ground when the group became the first consortium in Southeast Asia to successfully complete a proof-of-concept for a Know Your Customer (KYC) blockchain. It runs on a Distributed Ledger Technology platform which enables structured information to be recorded, accessed and shared across a distributed network using advanced cryptography. The KYC blockchain allows banks to collect, validate and share customer information – with the customer’s consent – accurately, efficiently and in securely.

According to the consortium, the prototype’s performance was tested between February and May 2017 for its functionality, scalability and security. It remained stable even with a high volume of information flow, was resistant to tampering by third parties and maintained confidentiality by permitting access to the ledger’s information only with legitimate authentication.

“The MAS has spoken about the importance for Singapore to ‘work smarter’ in how it fights financial crime in areas like banks’ approach to their KYC due diligence and through its use of technology. The launch of this KYC platform is an accumulation of all of these aims: collaboration, innovation, and crime prevention,” said Beaver Chua, head of financial crime compliance, HSBC Singapore.

Singapore’s central bank itself has also been working on a proof-of-concept for inter-bank payments using blockchain when it partnered with DLT company R3 and a consortium of financial institutions for ‘Project Ubin.’ Sopnendu Mohanty, chief fintech officer, MAS, said the simplification of processes that comes from having a single, distributed

record of information makes blockchain technology an attractive solution for the financial sector.

Project Ubin succeeded in its first trial in March 2017 on domestic interbank payments but issues on singularity, compatibility, governance, and technological sophistication emerged.

The second phase will focus on securities trading or payment for delivery, and the last phase will focus on cross-border payments.

Whilst blockchain is not entirely new, it’s only finding its footing mainstream over the past few years. Total investments globally to the blockchain and cryptocurrencies sector, for instance, steadily increased by 14.2% between 2014 and 2016, with the trend looking set to be maintained in 2017 with over $412m already invested in the first half of this year, according to Fintech Global.

Advertise

Advertise