Chart of the Week: Check out Hong Kong banks' growing exposure to the property sector

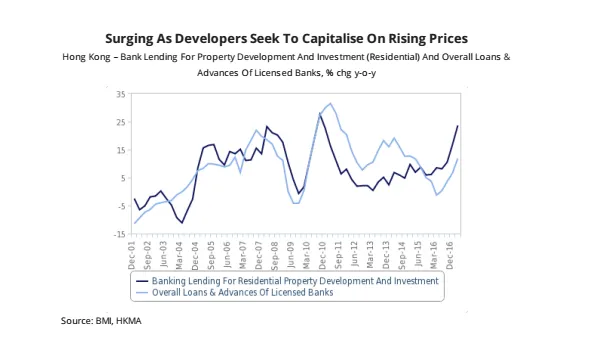

Direct lending by banks to developers increased 23.6% in March.

The impending increase in housing supply is partly due to the public housing to be built by the Hong Kong Housing Authority and Hong Kong Housing Society, but also a result of the response by property developers due to rising property prices.

BMI Research notes that indeed, property developers have been increasing their investments, and we are seeing this through the robust expansion in direct lending by banks to residential property developers, which has picked up strongly to 23.6% y-o-y in March (compared with 8.5% y-o-y in the same period in the previous year).

Here's more from BMI Research:

The city's banking regulator and central bank, the Hong Kong Monetary Authority (HKMA), is therefore wary of potential financial instability stemming from elevated house prices and growing exposure of banks to the sector. The regulator has therefore tightened regulations on bank lending to property developers on May 12, and we expect this to put downside pressure on loan activity.

Indeed, the HKMA stated in a circular that starting from June 1, all banks will be required to lower the cap on the amount that they can lend to property developers for construction financing.

Under the new policies, the maximum cap on bank loans used by the developer to purchase land will be reduced to 40% of the value of the site and 80% of the construction costs (from 50% and 100% previously). The overall limit will also come in at 50% of the expected value of the completed properties, which is down from 60% previously.

Advertise

Advertise