China's shadow banking crackdown finally cools credit growth

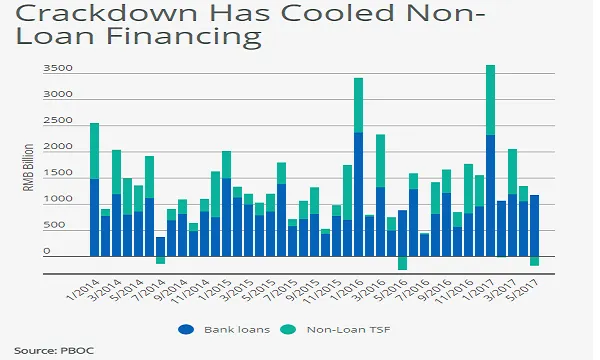

Bank lending growth has held up, while non-loan TSF declined in May.

There are early signs that the recent tightening of regulatory enforcement in China's financial sector is cooling credit growth in the shadow-banking sector. The authorities appear committed - for now - to containing financial sector risks, which could be positive for system-wide stability if maintained over the medium-term, says Fitch Ratings.

However, it remains to be seen if the authorities stay committed should economic growth slow faster than they are willing to tolerate. The authorities are at least likely to tread carefully, given the potential for policy mis-steps - such as the possible triggering of a credit crunch.

Here's more from Fitch Ratings:

The latest total social financing (TSF) data point to some migration of credit back on to banks' balance sheets, reversing the trend seen during the second half of 2016. Bank lending growth has held up, while non-loan TSF declined in May (see chart). The main drag on non-loan TSF was a fall in corporate bond issuance, which reflects weaker market liquidity and a rise in bank funding costs that has reduced incentives for banks to invest in corporate bonds and other non-loan financial products. Entrusted loans and bill acceptances also fell in May.

That said, monthly movements in TSF tend to be volatile. A rebound quickly followed on the last two occasions when regulatory tightening caused a monthly decline in non-bank TSF, in July 2014 and May 2016. Moreover, growth in overall TSF stock remains strong in yoy terms, and even rose slightly in April and May. The true test of the new policy stance will come if credit and economic growth start to slow down rapidly. The government is also unlikely to tolerate an extended slowdown in corporate bond issuance, which runs counter to its long-term ambitions to develop China's capital markets.

One potential risk involved in trying to contain financial risks is a credit crunch. The slowdown in non-loan activity has already contributed to a tightening of the interbank market, highlighting liquidity pressures. The interbank lending rate averaged 2.88% in May 2017, 23bp higher than in April 2017 and 78bp higher than in May 2016. Deposit growth has also weakened, and M2 growth fell below 10% yoy for the first time in more than 30 years in May.

The decision to relax the timeline for banks to conduct internal reviews of their practices, as reported by local media, suggests the authorities will at least be flexible in their implementation of enforcement, even if it does not signal a broad change in approach. They are likely to have been mindful that the original deadline on 12 June could have added seasonal tightness in liquidity.

Larger banks have benefitted from tighter liquidity as they are net liquidity providers to the second-tier banks, and we expect an improvement in their net interest margins. Large banks should also be less affected by tighter regulatory enforcement, given their lower exposure in the shadow-banking activities and stronger deposit franchises.

In contrast, smaller banks that rely more on the interbank market and shadow-banking activities are facing rising funding costs and capitalisation pressure as assets are brought back on to their balance sheets. Most banks reduced dividend payouts last year, and we expect them to remain low by previous standards. Some banks have plans to issue new capital, in some cases to support growth in on-balance sheet assets.

Advertise

Advertise