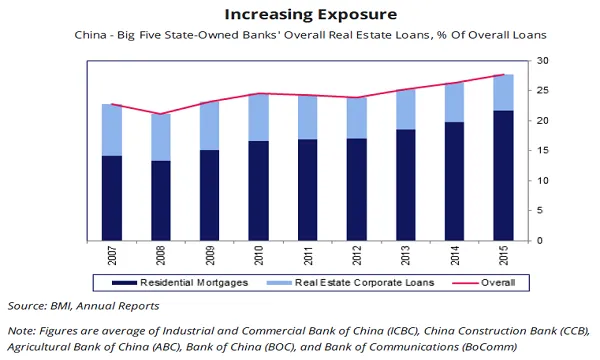

Chart of the Week: Chinese banks' real estate loan exposure rose to 27.7% in 2015

Residential mortgages accounted for 21.6% of total loans.

BMI Research notes that Chinese banks have been increasing their exposure to their property markets, and this poses downside risks to loan growth and financial stability.

Here's more from BMI Research:

The Chinese government has already implemented cooling measures to curb the rapid rise in house prices, with local governments in more than 20 cities announcing additional tightening measures such as increases in down-payments for first and second-time buyers, coupled with purchase restrictions in late-September and early-October (during the golden week holidays).

That said, in the near-term, there is still potential for additional price gains as local residents rush to buy new homes amid expectations of additional tightening measures and their fear of missing out. This could set the stage for a significant downturn down the road, which we believe would weigh on loan growth in mainland China.

Additionally, we believe that Chinese property firms and banks are exposed to substantial credit and liquidity risks, which would result in weakening of asset quality, in the event of a sharp price correction.

According to our calculations, direct loan exposure to the real estate market by the big five state-owned Chinese banks rose to 27.7% of overall loans in 2015 from 22.8% in 2007. Looking at the breakdown, residential mortgages and corporate loans accounted for 21.6% and 6.1% of their total loans, respectively, in 2015. Other than these usual mortgage loans, banks have become increasingly exposed to property developers through trust companies and directional asset management plans.

Advertise

Advertise