Find out how UOB's BizSmart lets SMEs cut costs by 60% and save time by 40%

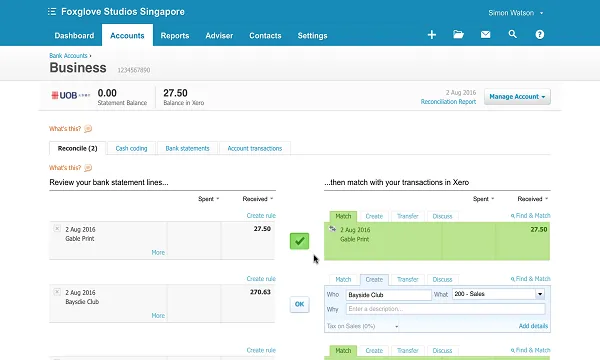

SMEs can have a direct feed from their operating accounts with UOB.

UOB recently announced the launch of BizSmart, a solution dedicated for businesses which turn to digitisation and automation to reduce costs and increase efficiency. It's the first cloud-based integrated business solution that helps save costs by 60% and save time by 40%.

In a release, UOB said the BizSmart solution enables small businesses, especially those in the retail industry, to handle their administrative work more efficiently. It integrates and manages on their behalf, back office processes such as payroll, accounting, inventory and resourcing.

It is also the only solution that gives small businesses a direct feed from their operating accounts with UOB, enabling them to reconcile transactions, such as purchase orders to suppliers and daily takings, with their bank statement in one simple click, on a daily basis.

Here's what you need to know about UOB's BizSmart:

What spurred the launch of this solution?

BizSmart was designed in response to the 2016 UOB Small Business Survey which found that four out of five respondents spend at least four days a month on administrative work, mainly on business development paperwork (60%) and inventory management (45%).

Instead of using integrated software solutions, 70% of SMEs polled said they are still using multiple software programmes to manage their business processes, which they also find time-consuming and unproductive. Three in four said they believed that their time spent on administrative work could be better used on improving their company’s bottom line.

What applications can SMEs use with BizSmart?

The BizSmart solution comprises five applications: retail management (Vend), employee scheduling and leave (Deputy), payroll automation (HReasily), accounting (Xero) and security (MobileIron). The system integration is done by Newstead Technologies.

With BizSmart, small businesses can benefit from cost savings of up to 60%, as compared with using multiple software programmes which cost more when purchased individually. Small businesses can also expect to spend only 2.5 days on administrative work, instead of the current four.

Who can avail of this solution?

BizSmart is available to existing and new UOB SME customers. SMEs purchasing the solution may also qualify for SPRING Singapore’s Capability Development Grant. SMEs can find out more about the service at uob.com.sg/bizsmart or at any UOB branch.

What do UOB's partners and customers say about BizSmart?

Alex Campbell, Managing Director for Xero Asia:

At Xero, we have seen how valuable innovations like our banking integrations have been to our more than 700,000 subscribers around the world. We’re proud to be working with UOB, as the first bank to integrate with Xero in Asia, to bring these innovations to markets such as Singapore where small businesses play an important role in the national economy.

The financial web enables banks and customers to meet and exchange information digitally, to speed timely access to financial services, while providing greater confidence in underlying data. This integration with UOB enables Singapore small businesses that use Xero to readily connect their bank account to Xero and unlock the power of the financial web. We believe this can fundamentally rewire how small businesses operate, lighting a fire under the engine room of our economies.

Pinko Celine Chua, general manager of ApexHub and a UOB Business Banking customer:

As the general manager of a small business, I often find myself spending weekends dealing with HR and accounting paperwork. I knew I had to try to automate my business processes but had no idea where and how to begin. As one of the pilot users of BizSmart, managing my HR, payroll and sales inventory processes is simpler and faster and I no longer have to spend days on administrative work and instead, can dedicate more time to growing the business.

Advertise

Advertise