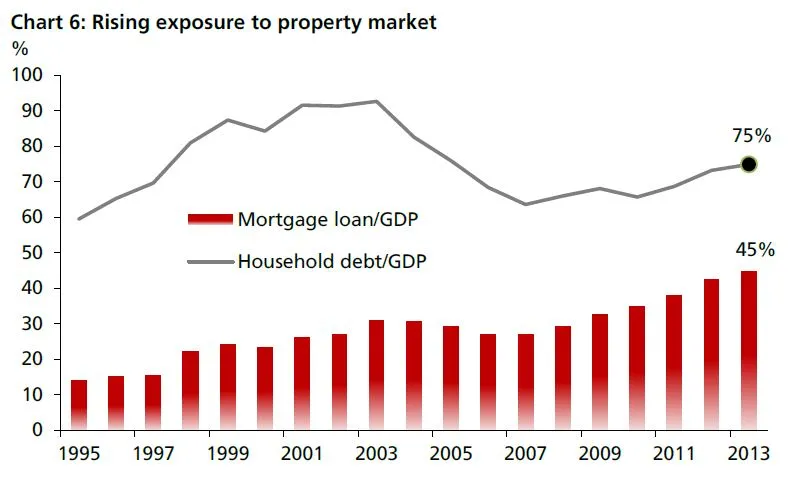

Singapore banks' rising exposure to property market is a looming doomsday

Household and mortgage loans are trekking north.

Banks are becoming more exposed to property market as buyers turn to them in their plight against the house measures.

According to DBS, the TDSR is one of the macro prudential measures employed by the MAS to curb excessive lending and mitigate the risk exposure of the banking system to the real estate sector.

Here's more from DBS:

Financial institutions are not allowed to extend additional loans to borrowers whose total monthly debt repayments exceed 60% of monthly income.

The aim is to limit consumer leverage and cool demand for loans, particularly large-ticket mortgage loans.

The property market is showing signs of moderation due to the series of cooling measures. This has led some to suggest that the MAS may unwind some of the earlier measures.

We suspect that will not happen soon, as the easing in property prices was the raison d’etre of the cooling measures. Absent a sharp fall in prices and / or rise in negative home equity, policymakers will likely allow the market to self-adjust over time.

The focus of monetary policy remains on managing overall leverage within the economy.

The household debt-to-GDP ratio rose to 75% in 2013 and appears to be continuing north. The mortgage loan-to-GDP ratio is at historical high of 45% while the LDR has continued to rise towards its historical peak almost a year after the introduction of the TDSR.

We suspect that these various measures against leverage will show little unwinding until interest rates begin to rise.

For most people, investment in property is a long-term commitment. Hence, it is important for potential home buyers to take into account the negative impact of interest rates on property prices, as well as to do the necessary “stress testing” to prepare for the higher interest rates that will eventually come.

This will help home owners determine whether their properties will remain affordable under higher rate scenarios.

Advertise

Advertise