Check out CIMB's smart innovation in managing electronic payments

It's Malaysia’s first-ever chip-based mobile point-of-sale payment solution.

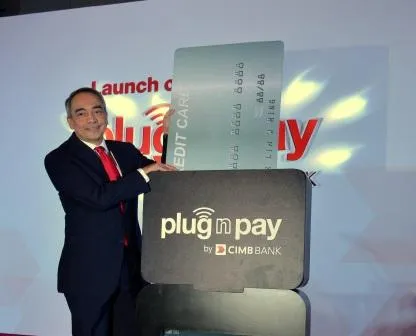

CIMB Bank launched Plug n Pay by CIMB Bank (“Plug n Pay”), Malaysia’s first-ever chip-based mobile point-of-sale (mPOS) solution that offers businesses of any size an affordable yet secure way to manage electronic payments

using their smartphones and tablets.

ABF: What spurred the launch of Plug n Pay?

There is a growing use of credit and debit cards in Malaysia. However, the ability to accept payments from customers who prefer card payment to cash is a common business challenge. This is especially true for those who conduct business “in the field”

or those who find the infrastructure costs of fixed point-of-sale solutions too prohibitive.

"Plug n Pay can be that game changer for these businesses. It transforms the mobile devices that are an integral part of our daily lives into tools of commerce that lets the consumers pay, and businesses receive payments in a very convenient, secure and cost

effective manner,” said Dato’ Sri Nazir Razak, Group Chief Executive, CIMB Group at the launch of Plug n Pay.

“Besides allowing the businesses to accept safe and secure credit and debit card payments, they can make use of our transaction banking services for easy settlement and monitoring of electronic payments. What this means for businesses in general is less handling of cash or cheques, which reduces the risk of holding cash,” added Nazir.

“This is also in tandem with our government’s effort to promote the adoption of electronic payments and to reduce dependency of cash transactions for greater economic efficiency. By encouraging wider accessibility as well as affordability of mobile point-ofsale

solutions for Malaysian businesses, Bank Negara Malaysia hopes to boost the number of cashless transactions per capita from 44 to 200 and reduce the usage of cheques by more than half from 207 million to 100 million by 2020,” he stated.

ABF: What's new about it for CIMB and your customers?

By simply plugging in the portable Plug n Pay card reader into their mobile devices, businesses can readily accept chip or signature-based credit and debit cards and safely conduct transactions using the Plug n Pay mobile app.

Upon confirmation of purchase, electronic receipts can be immediately issued to customers via email or SMS. Funds are available the next business day and are reflected directly in businesses bank accounts, thereby eliminating the wait for cashflow for these businesses. Plug and Pay also offers its users a comprehensive approach to managing electronic payments where they can view real-time transactions, track the location of a transaction using the geo-location feature and user details management via the mobile app and the web-based Plug n Pay portal.

The Plug n Pay solution is protected with end-to-end encryption and the app can only be activated if the correct security credentials are provided. Consumers can also be assured of a safe and secure cashless transaction using Plug n Pay as it is both EMV Level 1 and Level 2 certified – a global standard for authenticating credit and debit card transactions using the same chip-based security measures as conventional point-of-sale terminals.

“Security is of utmost importance to CIMB, and Plug n Pay is no exception. It is fully compliant with global EMV standards aim to reduce fraud associated with the existing technology to protect users during payment,” concluded Nazir.

The Plug and Pay device is priced at RM250 each and can accept any MasterCard and VISA branded cards. The mobile app is available on both the Apple App Store as well as Google Play Store.

Advertise

Advertise