UOB’s core net profit down 1% to S$1.6b in Q1 as interest income dips

Trading and investment income hit a record high, however.

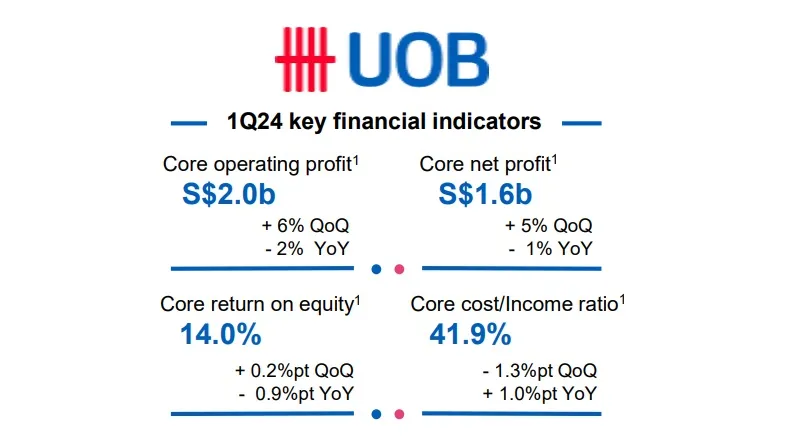

UOB’s core net profit fell by 1% to S$1.6b (US$1.79b) in Q1 2024 compared to the same quarter in 2023, according to its latest financial results.

Compared to Q4, net profit was 5% higher, driven by growth in net fee income and record trading and investment income.

Net fee income grew 5% to S$580m during the quarter compared to Q1 2023, driven by loan-related, wealth management and credit card fees, UOB said in a press release.

Net interest income dipped 2% from lower net interest margin compared with a year ago.

Other non-interest income rose 3% to S$581m, thanks to record trading and investment income.

“Customer-related treasury income hit a new high from increased retail bond sales and strong hedging demands,” UOB said.

ALSO READ: UOB to maintain good asset quality amidst profitability dip

Credit costs improved 2 basis points in Q1 compared to Q4 2023, while the non-performing loan (NPL) ratio is 1.5%. UOB’s Common Equity Tier 1 (CET1) ratio is at 13.9%.

UOB CEO Wee Ee Cheong highlighted the bank’s balance sheet and liquidity position as key factors that enabled the bank to deliver a “stable” set of results.

“Our core business franchise performed well, with higher fee income and record trading and investment income,” Cheong said.

Cheong also provided an update to the bank’s Citi integration following UOB’s purchase of four Citi retail franchises in Southeast Asia.

“Our Citigroup integration is progressing well. We recently successfully migrated customers in Thailand to our UOB platform following the smooth transition in Malaysia and Indonesia last year. Next year, we will complete the integration in Vietnam,” he said, adding that their focus so far had been on cross-sell synergies and is reportedly starting to gain good traction.

Advertise

Advertise