Chart of the Week: Indonesia’s card payments market to be worth $71.8b by end-2024

But point-of-sales terminal penetration remains low.

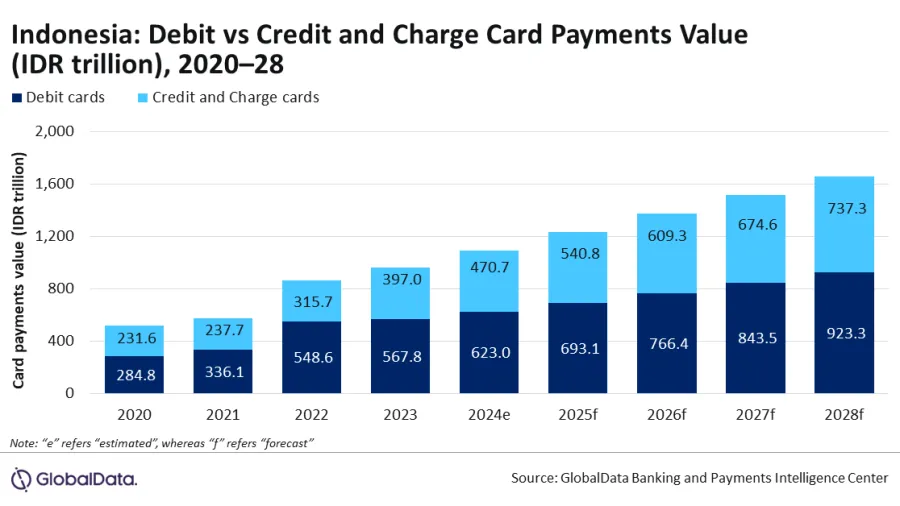

Indonesians’ ongoing shift towards non-cash payments will help buoy the country’s card payments market to a 13.4% rise to a $71.8b (IDR1,093.6t) market value in 2024.

This extends the 9.7% compound annual growth rate (CAGR) rise in Indonesian card payments value between 2019 to 2023. As of end-2023, the market is valued at $63.3b, according to data and analytics company GlobalData.

Debit cards clinched 58.9% of the overall card payment value in 2023. They have moved past being used for cash withdrawals and have increasingly been used for low-to-medium value transactions.

Despite lower penetration, consumers are also using their credit cards more for payments, thanks to perks such as reward points and discounts offered by banks.

ALSO READ: India floats regulations for non-bank POS payment aggregators

“Payment cards usage has grown during the past few years, supported by the Indonesian government's initiatives for financial inclusion, rising consumer awareness of digital payments, and infrastructure development such as the transition to EMV standards contributed to the shift towards card payments,” said Shivani Gupta, senior banking and payments analyst at GlobalData.

The government’s KEJAR program (One Student One Account) is one major factor helping drive the banking and card penetration in the country.

There’s still much room for growth. The number of POS terminals per 1 million inhabitants in Indonesia stood at just 7,264 in 2023, lower than many of its regional peers, highlighting significant scope for further development in POS infrastructure, GlobalData said.

ALSO READ: Superapps to help drive BNPL userbase to 670 million by 2028

“The higher costs involved in POS installation and associated merchant service fees remain the key challenges for the adoption, especially amongst smaller merchants,” it added.

Advertise

Advertise