ZA Bank officially unveils US stock trading service in Hong Kong

The bank charges a trading commission of US$0.012 per share.

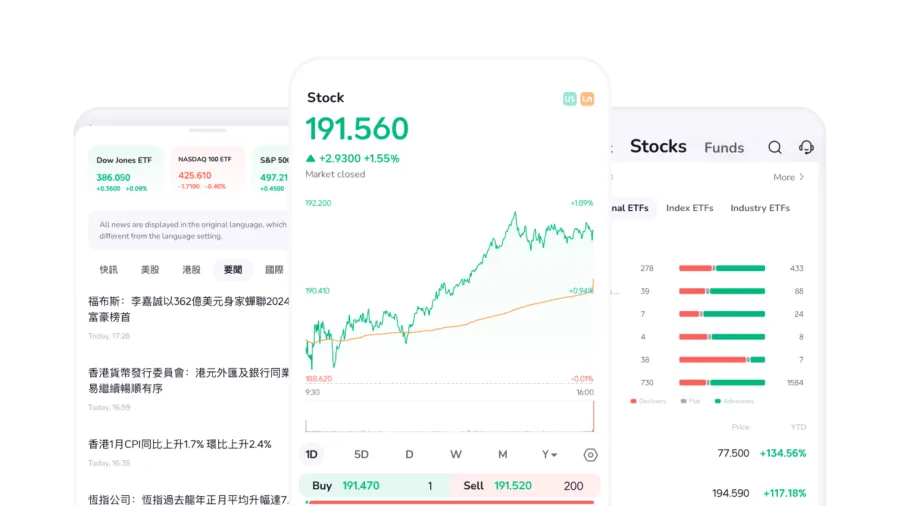

Hong Kong digital lender ZA Bank has officially launched its US stock trading service, offering access to over 6,000 US stocks and 3,000 ETFs.

The bank offers a trading commission of only US$0.012 per share, nearly 6 times lower than the market average, based on the average US Stock commission charges of 11 Hong Kong banks as of 20 February.

Customers of ZA Bank’s US stock trading service will also be able to trade directly without the hassle of making transfers, Transactions are directly debited or credited to their savings accounts.

The bank also offers free real-time quotes, 24 x 7 real-time financial news, market valuations, ETF classifiers and other professional analysis tools.

Interested users can activate the US stock trading service in as fast as 3 minutes and tap into the world’s largest stock market by capitalisation in a few simple steps.

To commemorate the launch, ZA Bank has launched a promotion period with lower commission rates on average and a higher savings rate.

ALSO READ: ZA Bank rolls out tax loan, offers cash rewards

From 27 February 2024 to 30 June 2024, the commission per transaction is as low as US$3.88.

Eligible ZA Bank users can also get up to a 10% per annum USD savings rate and up to an HK$133 reward upon opening US stock trading service and completing designated US stock transactions.

Those who successfully activate the stock trading service will enjoy +1% p.a. US savings rate-up coupon and up to an up 8,800 ZA Coins reward.

Users who complete US stock transactions of over US$300 will enjoy a further +0.2% p.a. USD savings rate-up coupon for each transaction, capped at +9% for each calendar month. They will also get 4,500 ZA Coins, equivalent to HK$45, for the first instance that they they successfully buy US stocks.

ZA Bank’s US stock trading service is currently available to Hong Kong users only.

Advertise

Advertise