Bank of East Asia unveils mobile app with personalised interface

Users can create shortcuts for frequently performed tasks and can avail of rewards.

The Bank of East Asia (BEA) has launched its new and redesigned mobile application.

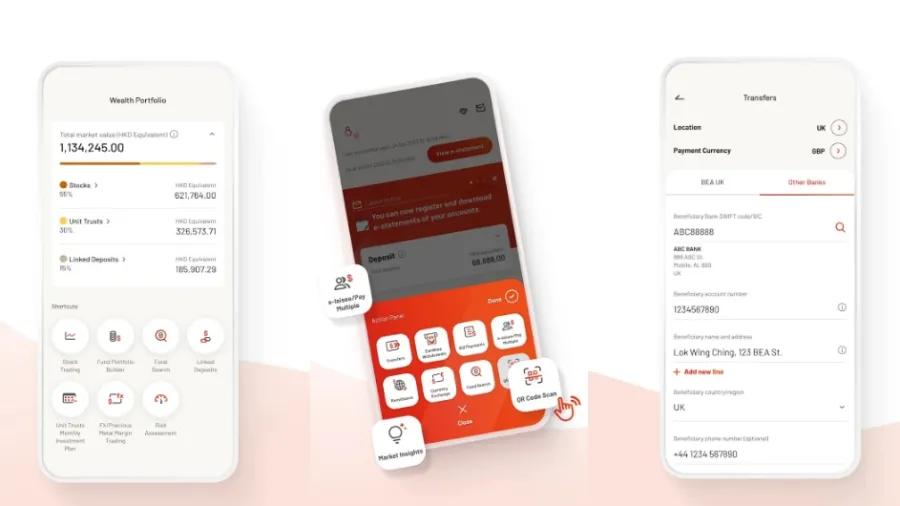

Customers have the option to personalise the user interface of their app, by creating shortcuts for frequently performed tasks such as transfers and remittances. They can also rearrange the sequence of their accounts so that certain data are easiest to say, such as balances and summaries of specific accounts.

New services include a “Challenge Mission” function that offers users a chance to win rewards by completing simple tasks.

The new app also provides a suite of wealth management services,with up to 14 investment functions, including trading stocks, unit trusts, linked deposits, and foreign currencies.

There is also a "Fund Portfolio Builder" that shortlists funds suitable for the customer to build a personalised fund portfolio. The all-new "Wealth Portfolio”, meanwhile, gives customers a holistic overview of their assets at a glance.

ALSO READ: BEA rebrands, upgrades digital services and bank branches

The app also offers travel protection insurance and a 24/7 foreign currency exchange function.

An estimated 3 in 4 or 75% of BEA’s customers have activated their accounts on the bank’s digital platforms, with close to 89% of them being affluent customers, said BEA’s general manager and head of personal banking division, Shirley Wong, commenting on the launch.

“Digitalisation is a key part of the retail banking business roadmap, in line with the group’s overall development strategy. We are committed to enhancing our digital banking services, such as mobile account opening, digital wealth management, and processing everyday financial transactions,” Wong said.

Overall, there was a 38% year-on-year increase in financial transactions through mobile channels, Wong noted, adding that this is indicative of the strong market demand for digital financial services."

Advertise

Advertise