Embedded finance, partnerships to shape future of SEA fintechs

Digital payments, WealthTechs, and cryptocurrency are also slated for growth.

Embedded finance, partnerships, and digital banks will be the three defining trends shaping Southeast Asia’s financial technology (fintech) landscape in the future, according to a report by YCP Solidiance.

“Embedded finance will integrate financial services directly into customer journeys, enhancing convenience and accessibility. Digital banks will disrupt the traditional banking model by offering fully digital and customer-centric financial services,” YCP Solidiance partner Takahiro Okawara, director Hiroshi Tsuchiya, and manager Samantha Wong wrote in a whitepaper exploring fintech trends in the region.

More fintechs are expected to collaborate with traditional financial institutions, both as a means to drive innovation and financial inclusion, it added.

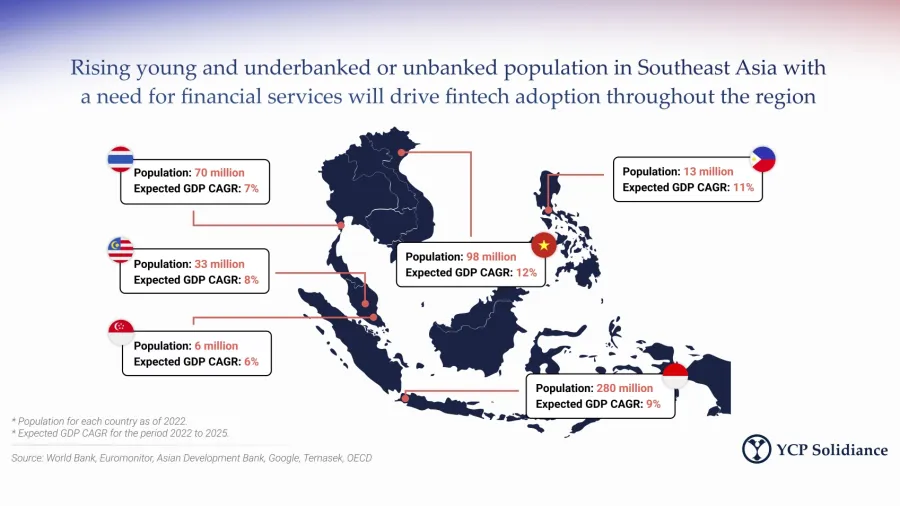

Overall, Southeast Asia’s fintech industry is flourishing thanks to a rapidly growing digital economy and a tech-savvy population.

Digital payments, including mobile wallets and QR code payments, is expected to accelerate further thanks to the continuous growth of e-commerce as well as increasing preference for cashless transactions.

“Cross-border payments are also expected to become more seamless and efficient, facilitating trade and remittances across the region,” YCP Solidiance noted.

ALSO READ: Cross-border payments, embedded finance to be boosted in 2024: analyst

Along with payments, digital credit demand is also poised to become a primary revenue driver for SEA financial services, with automated loan procedures speeding up approvals and expanding access to underserved segments.

Wealth management will also play a role in expanding the fintech space, with WealthTechs, robo advisers, and other digital financial platforms slated for growth as investors of all income levels seek wealth advisory services.

Cryptocurrency adoption is expected to continue growing in Southeast Asia and will lead to changes in regulations.

“Regulatory frameworks will evolve to provide clarity and address concerns surrounding cryptocurrencies. Cryptocurrencies will be explored for new use cases, such as cross-border payments and remittances,” the experts wrote.

The insurance industry will also see transformation with the growth of InsurTech. Microinsurance and parametric insurance have enabled access to affordable insurance solutions. YCP Solidiance expects partnerships between InsurTech companies and traditional insurance providers to accelerate innovation and market reach.

Advertise

Advertise