SEA digital payments slated for growth as e-commerce market doubles: study

BNPL is projected to grow by 38% over the next five years.

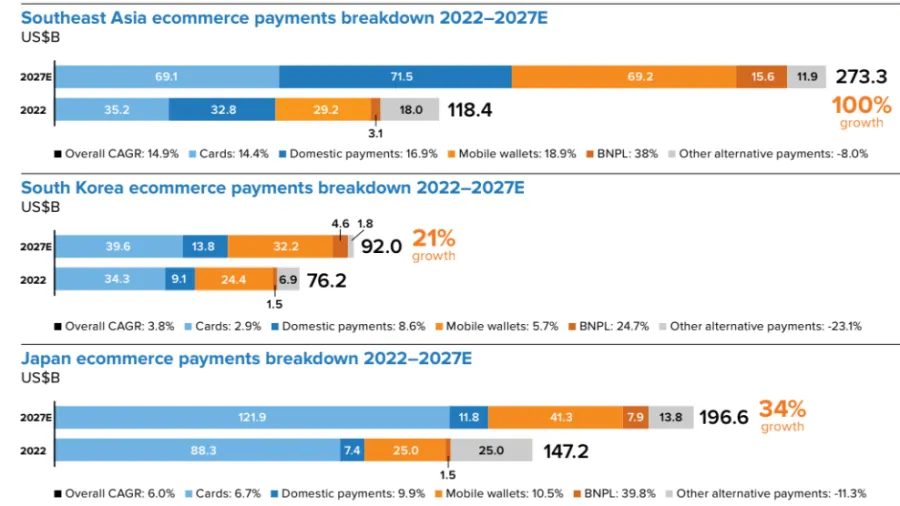

Southeast Asia’s digital payments is expected to grow over the next five years in tandem with its e-commerce market doubling, according to a report by Ant Group and 2C2P.

Buy Now Pay Later (BNPL) will register the most growth, at 38%. Mobile wallets are projected to grow by 18.9% during the period, whilst credit cards will expand by 14.4%, the study said.

SEA, South Korea, and Japan’s digital economies combined are anticipated to grow by 15.8% in the next five years and will be collectively worth $914.9b by 2027, the study said. This is nearly double its 2022 value of $501.7b, marking an 82% leap in just five years.

Cross-border revenue will also surge during the period. Private and public sector efforts are poised to inject $232.4b in fresh cross-border revenue into the SEAKJ economies from 2022 to 2027E, driven by e-commerce and tourism spending gains, 2C2P and Ant Group said.

ALSO READ: Financial regulators in ASEAN pledge to bolster partnerships, region to grow 4.5%

In line with this, cross-border e-commerce revenue is primed to grow by a striking 70% to $148.1b by 2027E, outpacing the growth of domestic e-commerce revenue.

“Digitalisation will have a significant positive impact across Asia, shaping the future of businesses and lifestyles,” said Douglas Feagin, senior vice president of Ant Group and head of Alipay+ Cross-Border Mobile Payment Services.

However, Feagin warned that the rapid rise in the number and diversity of digital payment options does present a challenge, especially for small to mid-sized merchants.

“By working with our partners to enable them to easily accept many different payment options through one easy-to-use interface, we have seen very encouraging results. This has been particularly important with the ongoing increase in online consumption and resumption of cross border travel,” Feagin said.

ALSO READ: Fintech funding in SEA freefalls 74% in Q3

“From global online platforms to small street side merchants, it is now imperative for businesses to cater to these digital habits, and I believe that by working together, we can help more consumers and businesses benefit from digitalisation,” he added.

Advertise

Advertise