Hong Kong’s Mox unveils unlimited cashback rewards, new wealth platform

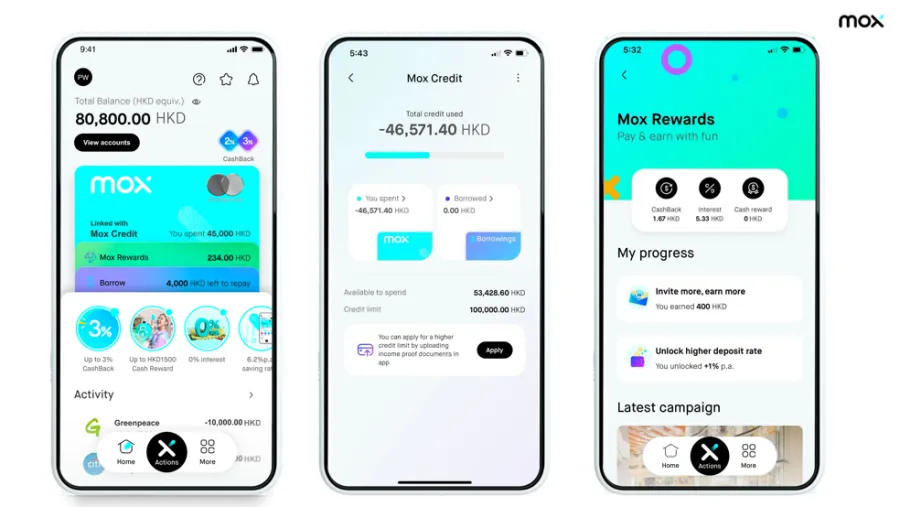

The virtual-only bank is also gearing up to launch a new app interface.

Hong Kong virtual bank Mox is celebrating its 3rd anniversary with Unlimited CashBack rewards for Mox Credit customers.

From 26 September to 31 December 2023, Mox Credit customers can also earn 3% cashback up to HK$600 at selected CashBack merchants, including HKT, Trip.com, 7-Eleven, Circle K, Mannings, and Watsons, amongst others.

Cashback rewards include:

- 1% Unlimited CashBack on any spending;

- 2% Unlimited CashBack on any spending if you have a savings balance of HKD75K or above;

- 3% Unlimited CashBack on all supermarkets, including Fusion, Market Place, Wellcome, and ParknShop.

In the coming year, Mox plans to expand its offerings through attractive rewards and an app upgrade, said CEO Barbaros Uygun.

ALSO READ: Mox receives licence for HK-US equity trading services

Wealth management entrance

Mox is also making its debut in the wealth management space with Mox Invest.

Currently, Mox is piloting Mox Invest’s Hong Kong and U.S. equity trading service in the sandbox.

The virtual bank is also looking to add a Securities and Futures Commission (SFC) authorised yield enhancement fund that will only be available via the Mox app in collaboration with a world-renowned partner.

Mox is also exploring other new portfolio investment solutions.

ALSO READ: ‘Optimism’ drives credit activity growth in Hong Kong

New app interface

Mox is also rolling out a new app interface and will add new features such as taking screenshots of a mobile phone and automatic generation of descriptions.

New sections will also be added: Mox Credit and Mox Rewards, to provide customers a single location to look at credit and installment information and track their earnings progress.

It will also feature “Smart Swipe” and “Dedicated Hubs”, which Mox said will provide customers with a summary of vital information at a glance.

Advertise

Advertise