Alliance Bank Malaysia's Virtual Credit Card wins New Consumer Lending Product of the Year at Asian Banking & Finance Awards

The revolutionary Virtual Credit Card with Dynamic Card Number feature sets new standards in digital banking, offering enhanced security and eco-friendly transactions.

Alliance Bank Malaysia continues to lead the banking industry with its innovative product, the Virtual Credit Card (VCC) featuring the Dynamic Card Number (DCN). This groundbreaking offering has earned the prestigious New Consumer Lending Product of the Year - Malaysia award at the ABF Retail Banking Awards, showcasing the bank's unwavering commitment to delivering secure and cutting-edge solutions to its customers.

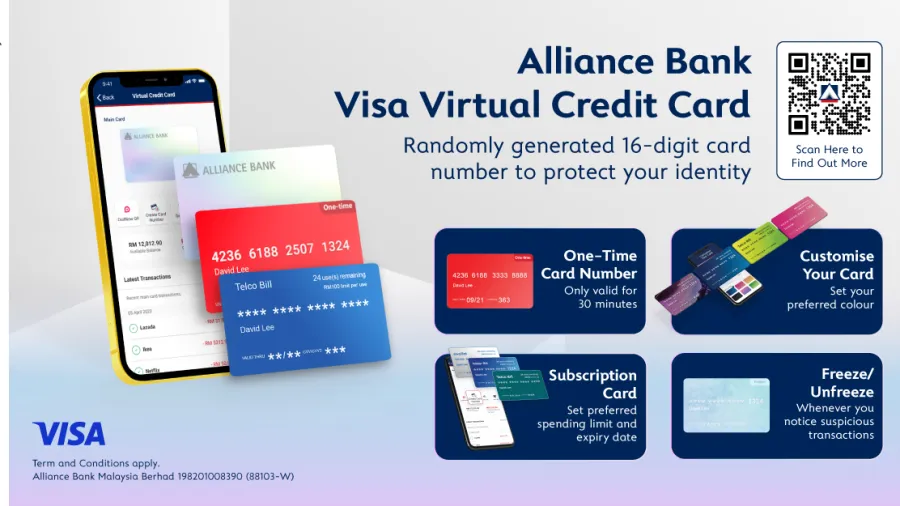

Introduced on the alliance online mobile app in April, the Virtual Credit Card with DCN sets a new standard for digital banking solutions in Malaysia. This numberless card enables customers to apply for a fully digital virtual credit card and conduct secure transactions using randomly generated DCNs for one-time or recurring payments. The convenience of managing all DCNs through their mobile phones eliminates the need to handle traditional card details.

One of the key advantages of Alliance Bank's VCC is its enhanced security compared to conventional credit cards. The single-use Dynamic Card Number reduces the risk of fraud, identity theft, and financial scams. Customers can also temporarily freeze or delete specific DCNs in case of suspicious or unauthorised transactions, ensuring a seamless and secure banking experience.

Beyond its security features, the Virtual Credit Card aligns with Alliance Bank's commitment to environmental sustainability. As a fully digital product, it enables cardless, cashless, and paperless transactions, contributing to a reduction in plastic credit card production and minimising the credit card footprint on online channels. This eco-conscious approach reflects the bank's dedication to driving positive change for both society and the environment.

Since its launch, the impact of the VCC with DCN has been exceptional. Credit card acquisition has increased by 1.5 times, and average card spend has surged by an impressive 41%. This significant boost in customer engagement demonstrates the product's ability to meet evolving customer needs and deliver a secure and seamless digital banking experience.

Furthermore, Alliance Bank has achieved an impressive 83% reduction in the acquisition cost of the Virtual Credit Card by embracing a digital-first approach, eliminating the need for sales staff and reducing associated costs. This cost-effective and streamlined solution allows the bank to pass on savings to customers, enhancing the value proposition of the VCC.

Advertise

Advertise