India’s card payments to triple in size by 2027: GlobalData

It is expected to triple in size to $728.2b in 2027 from last year’s $262.1b.

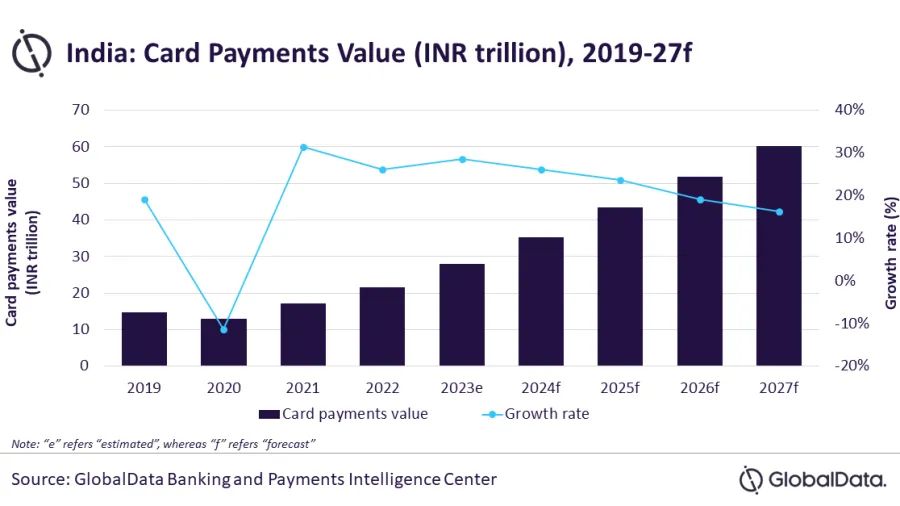

India's card payments market is expected to triple in size to $728.2b in 2027 from last year’s $262.1b, GlobalData reported.

It would be driven by increased consumer spending, according to GlobalData, a data and analytics company.

India experienced robust growth in card payments of 26.2% in 2022, supported by improving economic conditions, GlobalData's Payment Cards Analytics indicated.

This upward trend is expected to continue in 2023, with a projected growth of 28.6%, reaching $337.2b.

“India, which is primarily a cash-driven economy, made robust progress in the adoption and usage of card payments supported by improvement in payment infrastructure, and constant efforts by financial authorities to increase financial inclusion and boost cashless payments.” said Ravi Sharma, Lead Banking and Payments Analyst at GlobalData.

Credit and charge cards led post-COVID-19 recovery in card payments, growing to 53.0% in 2021 and 46.7% in 2022.

Increased consumer spending on travel, accommodation, restaurants, and transportation, along with loyalty programs and discounts, fueled this growth. The trend is expected to continue in 2023, with credit and charge card payments projected to grow by 38.1%.

In contrast, debit card payments are anticipated to grow at a slower pace of 9.5% during the same period.

ALSO READ: Indian banks’ bad assets improve to 10-year low: CareEdge

The government's efforts to enhance electronic payment infrastructure also contributed to card payment growth.

The Reserve Bank of India (RBI) established the Payments Infrastructure Development Fund (PIDF) in January 2021 to expand payment infrastructure. Subsidies on POS terminal and QR code installations are offered through this fund.

In June 2022, the RBI's directive linked credit cards with the instant payment system UPI, potentially revolutionising credit card usage in the country. The move enabled cardholders to pay merchants using saved RuPay credit cards via UPI.

Central banks, including Punjab National Bank, Union Bank of India, Indian Bank, HDFC Bank, Axis Bank, Kotak Mahindra, and Bank of Baroda, began offering this service.

GlobalData emphasised this integration is likely to encourage small merchants to accept card payments through existing QR code scanners, eliminating the need for additional POS terminal costs.

Advertise

Advertise