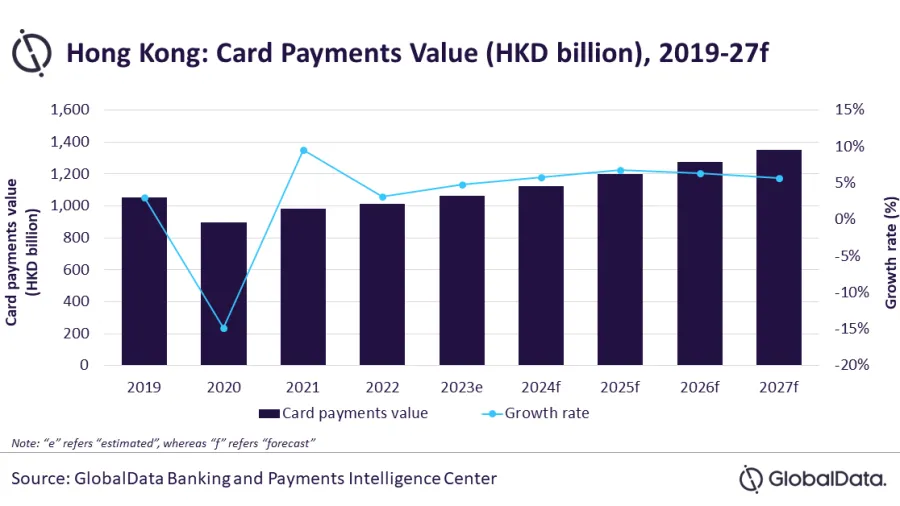

Chart of the Week: Hong Kong’s card payments market to grow 4.8% in 2023

Growth of e-commerce will spur card payments’ growth even further.

Growing preference for electronic payments and the city’s economy rebounding are expected to carry Hong Kong’s card payments to a 4.8% growth in 2023.

In a report, data and analytics company GlobalData said that the value of card payments in the city will reach HK$1.06b ($136b) by end 2023, growing faster than the 3.2% growth reported in 2022.

“The convenience of electronic payments, well-developed payment infrastructure, a growing preference for contactless, and e-commerce payments are all facilitating increased payment card usage in Hong Kong,” said Ravi Sharma, lead banking and payments analyst, GlobalData.

Credit and charge cards are the preferred payment cards, accounting for 71.7% of card payments value in 2022. This is mainly due to the associated reward programs, said Sharma, which makes it more beneficial than debit cards for consumers.

Credit cards also have wider acceptance among merchants, while debit cards are not that popular, Sharma added.

Debit cards accounted for the remaining 28.3% share of card payments in 2022. The key reason for low debit card usage is the limited acceptance of domestic EPS debit cards. These cards can only be used for offline payments in the country.

E-commerce growth is also anticipated to support Hong Kong’s payment card market. According to GlobalData’s 2022 Financial Services Consumer Survey, credit cards are the most preferred payment method for e-commerce payments accounting for over one-third of total online purchases.

GlobalData’s 2022 Financial Services Consumer Survey was carried out in Q2 2022. Approximately 50,000 respondents aged 18+ were surveyed across 40 countries.

Advertise

Advertise