CIMB on track to realise sustainability goals

The bank doubled its sustainable finance target after achieving the initial target in 2022.

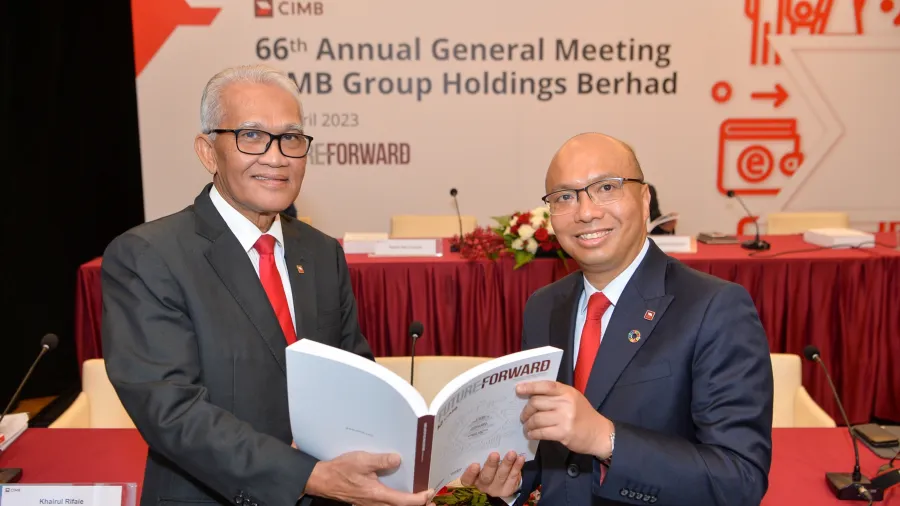

CIMB Group Holdings Berhad said that it is on track to realise its Forward23+ ambitions and sustainability finance targets in its latest annual general meeting with shareholders.

The bank doubled its sustainable finance target to RM60b by 2024–from RM30b previously)– after it achieved its initial target two years ahead of schedule in 2022.

CIMB said that it has also invested RM34.4m into communities across ASEAN as part of its commitment to invest RM150m into community initiatives over a five year period.

The group also achieved the 80th percentile on the S&P Global Corporate Sustainability Assessment (CSA). This is in line with its Forward23+ target to rank in the top quartile by 2024.

ALSO READ: OCBC NISP allocates $87.5m of 2022 net profits as cash dividend

“The Board will continue to provide oversight and guidance to ensure the Group achieves its Forward23+ strategic plan to deliver sustainable financial returns whilst creating shared value for all our stakeholders,” said Datuk Mohd Nasir Ahmad, chairman of CIMB Group, speaking at the AGM.

“When we first formulated our Forward23+ Strategic Plan in 2020, it was predicated on creating sustainable shareholder value through meaningful improvements to the Group’s annualised ROE. As we move past the midpoint and with two years to go, our strategy is making positive headway with strong momentum towards delivering our Forward23+ ambition of becoming the leading focused ASEAN bank by 2024,” said Dato’ Abdul Rahman Ahmad, Group CEO of CIMB Group.

In 2023, Dato Abdul Rahman added that CIMB will focus on growing targeted segments, especially its affluent and wealth management business.

In particular, the bank will focus on growing our deposits and CASA franchise, transaction banking and regional ASEAN network business.

Advertise

Advertise