India’s card payments market to grow 23.6% to $361.6b in 2023: analyst

Rising consumer spending will rally the market to extend 2022’s growth.

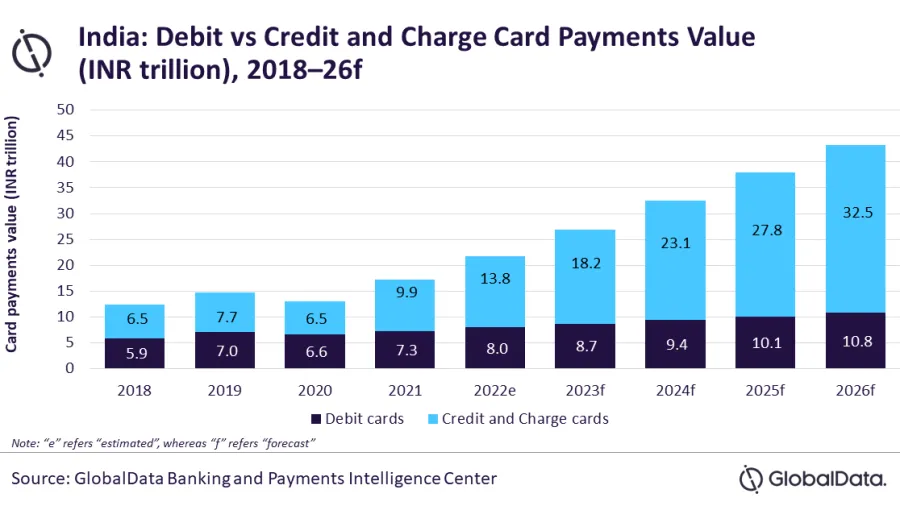

India’s card payments market will grow by 23.6% to reach $361.6b (INR26.9b) in value in 2023, says data and analytics firm GlobalData.

Improving economic conditions carried card payments value in India to grow 26.7% in 2022. Rising consumer spending will help rally the market to growth in 2023.

India’s card payments market is further estimated to grow at a compound annual growth rate (CAGR) of 18.7% between 2022 and 2026 and be worth $581.1b (INR43.3t) by 2026.

“India, which is primarily a cash-driven economy, made robust progress in the adoption and usage of card payments supported by consumers’ increasing preference for electronic payments, improvement in payment infrastructure, and constant efforts by financial authorities to increase financial inclusion and boost cashless payments,” said Kartik Challa, senior banking and payments analyst at GlobalData.

ALSO READ: UPI’s linkage to SG’s PayNow a step closer to global payment brand ambitions: analyst

The introduction of low-cost banking services under Pradhan Mantri Jan Dhan Yojana (PMJDY) program, the appointment of banking correspondents to serve the remote population, the launch of payments banks, and the reduction of merchant fees on card-based payments are some of the initiatives from the government and the central bank that led to rise in card payments in the past few years, according to GlobalData.

The post-pandemic recovery in card payments is mainly driven by credit and charge cards, with this card category growing by 39.2% in 2022, as consumer spending increased on travel, accommodation, restaurants, and transportation.

“The same trend is expected to continue in 2023, with credit and charge card payments expected to drive total card payments growth,” Challa said.

Advertise

Advertise