Indian banks’ Adani exposure minimal: Moody’s

Eexposure is less than 1% of banks’ total loans, the ratings agency estimates.

Indian banks’ exposures to Ahmedabad-based conglomerate Adani Group are minimal, and are not expected to present risks for banks’ loan quality unless funding demand from the company rises, according to a report by Moody’s.

Adani Group’s equity and bond prices have dropped significantly over the past two weeks after investment research firm Hindenburg Research released a report accusing the company of stock manipulation and fraud. Adani’s falling stock price had led its flagship unit to cancel its $2.5b share sale. Adani has since denied the report.

“Banks' exposures to Adani are not large enough to affect their credit quality materially,” Moody’s said. “Whilst we estimate that the exposures are larger for public sector banks than for private sector banks, they are smaller than 1% of total loans for most banks.”

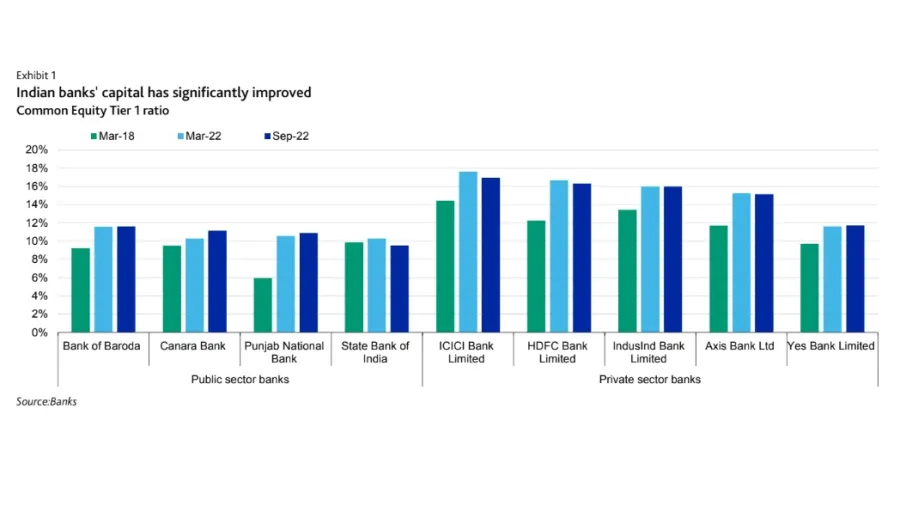

Banks' improved capital buffers and profitability will further enable them to absorb any potential losses from their exposures to Adani without materially hurting their credit strength, Moody’s added.

Also, the exposures are spread across various entities in the group, which reduces risks.

ALSO READ: India’s card payments market to reach $581.2b by 2026

“We estimate that the bulk of the exposures are collateralized, either with operational assets or with projects under execution, rather than to the corporate level. Whilst some of the exposures may be to the less mature assets of the group, the concentration on operating entities nevertheless reduces risks,” Moody’s said.

However, Moody’s warned that risks could rise if Adani becomes more reliant on loans from local banks. The allegation has likely curtailed the group’s access to funding from international markets due to Adani now holding a heightened risk perception, the ratings agency wrote.

“In that case, domestic banks may become the main source of funding for the group, resulting in increases in banks' exposures to Adani and greater risks for them,” Moody’s warned.

Advertise

Advertise