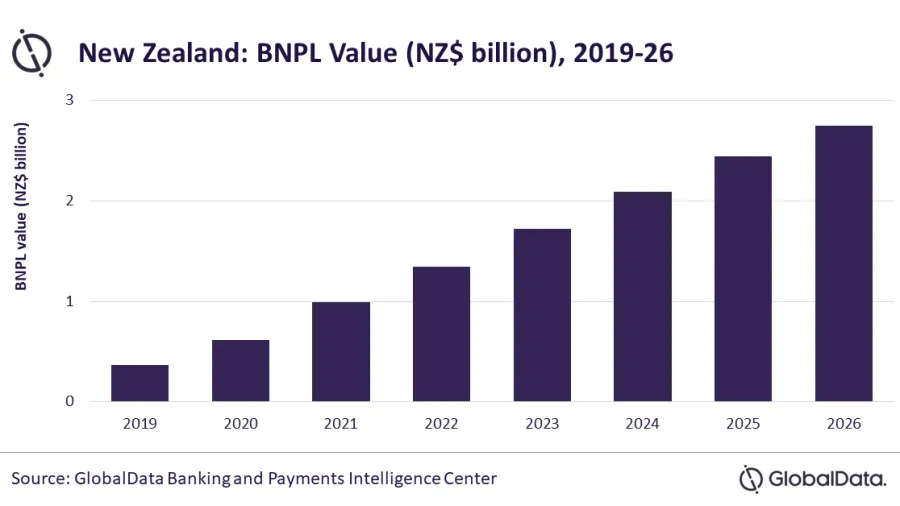

Chart of the Week: New Zealand’s BNPL market value to reach $1.2b in 2023

By 2026, the transaction value is expected to grow to $1.9b.

New Zealand’s buy now pay later (BNPL) market is estimated to be valued at $1.2b (NZ$1.7b) in 2023, a 28.3% growth in just a year, according to a report by GlobalData.

By 2026, the transaction value in the BNPL market is expected to reach $1.9b, growing at a compound annual growth rate of 16.7% between 2023 and 2026, the data and analytics company said.

BNPL has emerged as a popular form of payment in New Zealand. Afterpay remains the leading brand with over half of respondents polled by GlobalData choosing it as a preferred option, followed by Laybuy and Zip.

High consumer awareness, rising demand for short-term finance especially amongst millennials, and proliferation of BNPL payment providers has pushed BNPL’s popularity in New Zealand, noted Shivani Gupta, senior banking and payments analyst at GlobalData.

ALSO READ: Buy now, pay later gains traction in Asia

“Further, with the pandemic adversely affecting consumers’ disposable income, the demand for short-term consumer financing solutions has increased in the past couple of years,” Gupta added.

As a result of its growing popularity New Zealand’s Minister of Commerce and Consumer Affairs has reportedly proposed a regulation in November 2022 to protect consumers from falling into debt trap. BNPL will be brought under the purview of Credit Contracts and Consumer Finance Act 2003.

In particular, BNPL providers will be required to evaluate consumers’ repayment capacity before offering them credit above a threshold of NZ$600 ($410.7).

ALSO READ: Alternative payments inch closer to e-commerce domination in New Zealand

BNPL lenders are also required to assist borrowers in “making informed decisions and help them with repayment during unforeseen circumstances.”

The regulation is currently under discussion and is expected to be passed later in 2023.

Advertise

Advertise