Singapore fintech talents record 2nd highest turnover rate globally: study

Beyond attractive compensation, fintechs should also emphasise wellbeing, flexiwork.

Whilst hiring remains robust in Singapore’s fintech industry, retaining talent is another challenge of its own, with the city’s fintech professionals recording the second-highest turnover rate amongst nine key fintech hubs worldwide, Robert Walters’ latest Global FinTech Talent Report found.

Fintech professionals in Singapore have an average tenure of 1.3 years before changing jobs–second only to China, where fintech talent stay at one job for only 0.8 years or about 9-10 months.

In contrast, fintech talents in New York and the Netherlands have an average tenure of 2 years; San Francisco, 1.8 years; Spain and Japan, 1.7 years; Australia, 1.5 years; and the UK, 1.4 years.

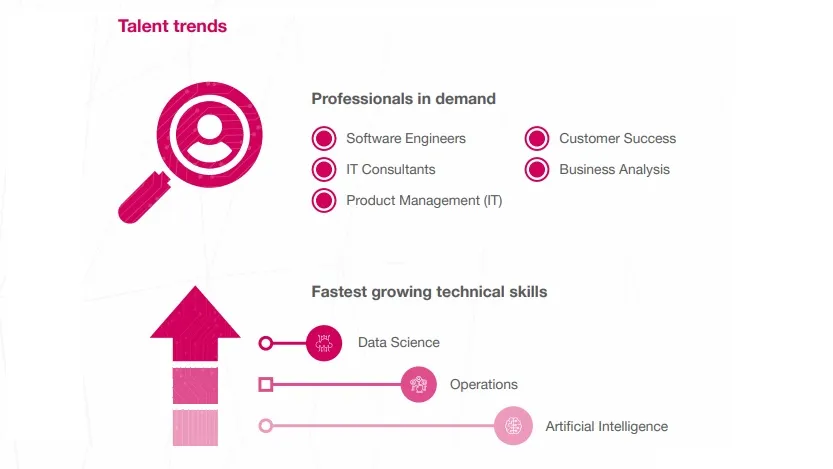

Demand for talent in Singapore remains high. In 2021, there was a 163% increase in the total number of fintech jobs on offer in the Lion City.

Fintech companies looking to aggressively hire and retain talent are advised to look beyond attractive compensation packages and offer flexible working arrangements whilst keeping communication open between staff and management.

“In a candidate short market where there are more jobs available than professionals, compensation in terms of salaries and stock options continue to play a big part in

FinTech professionals' career decisions. However, they are also balancing this need with a desire for good work-life balance and open and effective management,” said Faiz Modak, associate director, technology, Robert Walters Singapore.

For example, Fintech businesses who are unable to match professionals’ expected compensation packages can instead emphasise flexibility through remote working arrangements, Modak said.

They can also offer opportunities for training and upskilling especially in areas of cutting-edge technologies that talent will be unable to experience elsewhere

Hiring managers should also work to deepen their engagement with existing talent by addressing concerns and implementing creative solutions to address issues in flexibility and wellbeing, according to Robert Walters.

Fintechs should also clearly communicate the company’s corporate stand in areas such as cultural matters and diversity, the report wrote.

Advertise

Advertise