Thailand bank loans up 6.9% in Q1

Corporate loans continue to grow whilst consumer loans slowed amidst the Omicron outbreak.

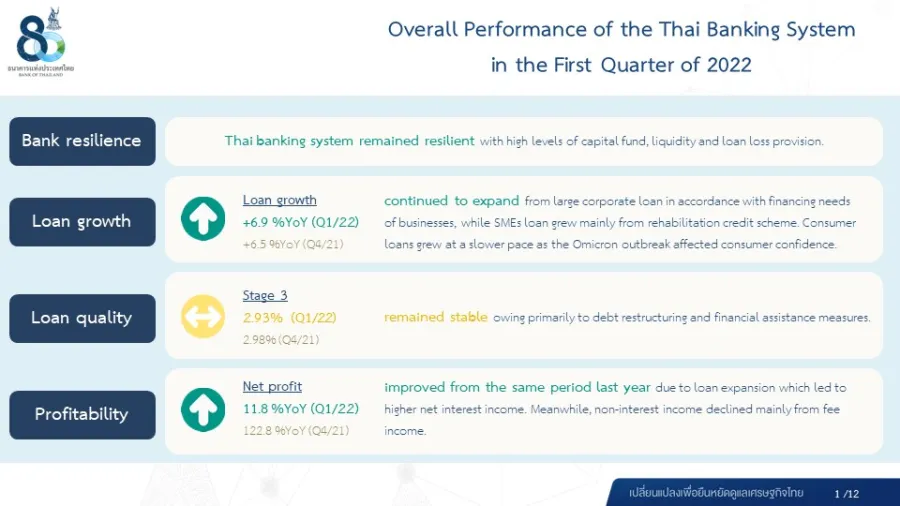

Thailand banks’ loan growth hit 6.9% in the first three months of 2022, higher than the 6.5% recorded in the fourth quarter of 2021, according to a report from the Bank of Thailand (BOT). Overall loan quality also remained stable during the quarter.

Corporate loans grew 8.8% year-on-year, extending the 7.9% rise in Q4 2021. Large corporate loans expanded in almost all business sectors, which reflected the financing needs of businesses as the economy recovered, the central bank said.

SME loans also grew, mainly from the rehabilitation credit scheme.

In contrast, consumer loans reported a 3.3% growth, slowing from the previous quarter as the Omicron outbreak hit on consumer confidence. Mortgage loan growth slowed in line with the decline in housing demand. Auto loans remained stable, with growth in domestic car sales becoming more evident.

Consumers' credit card loans expanded in tandem with an increase in credit card usage. Personal loans continued to grow due to households’ liquidity needs, BOT said.

Overall loan quality in the first quarter of 2022 remained stable, which the central bank said was thanks primarily to debt restructuring and financial assistance measures. The gross non-performing loans (NPL) increased marginally to over $15.3b (THB531.9b), equivalent to the NPL ratio of 2.93%.

The ratio of loans with significant increase in credit risk to total loans stood at 6.09%, lower than the 6.39% in Q4 2021.

In terms of net profit, the banking system’s performance continued to improve. Thai banks recorded a net profit of over $1.42b (THB49.4b) in the first quarter of the year, an 11.8% increase from the same quarter last year. This was due primarily to loan expansion which led to higher interest income, while non-interest income decreased mainly from fee income, BOT said.

Compared to the previous quarter, net profit improved due to the bank's operating cost control and lower provisioning expenses.

Net interest margin (NIM) also remained stable at 2.45%.

(US$1 = THB34.56)

Advertise

Advertise