Travel-seeking Millennials, Gen Z could boost buy now, pay later: study

BNPL services could even inspire a lifetime of loyalty, according to GlobalData.

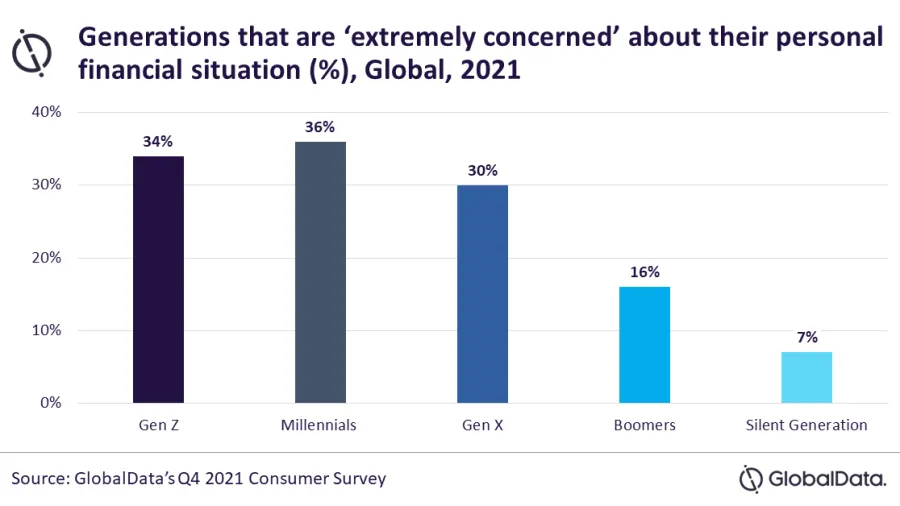

Millennials and Gen Z will drive demand for buy now, pay later (BNPL) schemes, according to a study by GlobalData, adding that this demand could serve as a boon for airline firms should they play their cards right.

“Buy now pay later could play a key part in the recovery of airlines that have adopted this payment method. Flexibility and affordability are key influencing factors for younger travelers, and this solution could even inspire a lifetime of loyalty,” said Ralph Hollister, travel and tourism analyst at GlobalData.

Millennial and Gen Z travelers looking to travel may be attracted to airlines offering BNPL services. An example is Southwest Airlines, which deepened its partnership with BNPL service-provider Uplift in January 2022.

“Uplift’s use of the terms ‘interest-free’ and ‘no late fees’ will no doubt attract price-sensitive millennial and Gen Z travelers that are looking for flexible, low-cost payment methods,” Hollister said.

BNPL also reportedly enhances accessibility as smaller payments can be made over several months, which translates to higher load factors, he added.

Apart from Southwest Airlines, Delta also recently entered a joint venture with American Express, allowing Amex fliers to break up their Delta purchases into monthly payments for an additional fee.

“Airlines such as Delta can’t afford to only be seen as a premium service, as it will struggle to attract Gen Z and millennial passengers. Through this payment option, Delta can get its foot in the door with these younger cohorts, then try to create repeat custom through its loyalty program,” Hollister said.

Advertise

Advertise