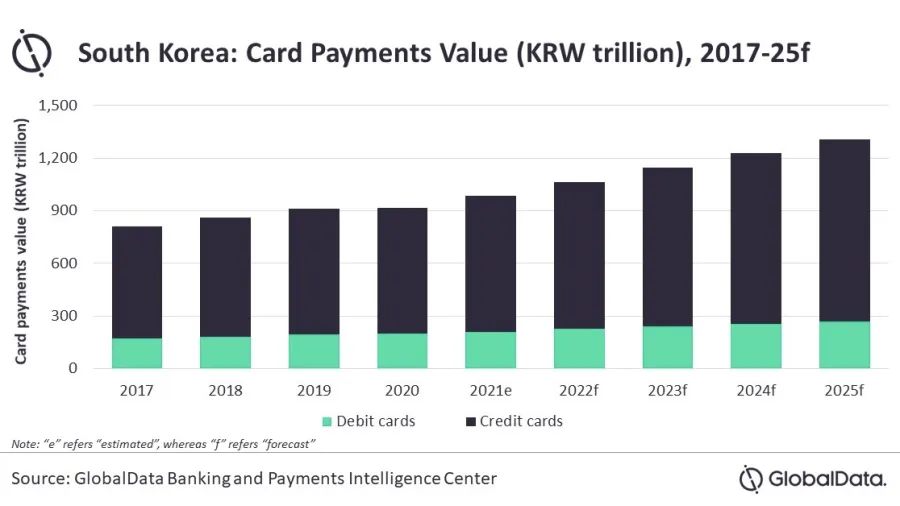

Chart of the Week: South Korea’s card payments market to reach $1.2t in 2025

Government incentives will support its continued growth.

South Korea’s card payments market is expected to reach $1.2t (KRW1,307.7t) in 2025, growing at a compound annual growth rate of 7.4%, according to data and analytics firm GlobalData.

In 2021, the value is estimated to jump by 7.3% and reach $903.3b.

The large rise is thanks to South Korea being amongst the few nations which effectively handled the COVID-19 pandemic compared to other developed markets, such as the US and the UK.

Whilst a complete lockdown was not implemented, the country’s comprehensive testing, quarantine, and treatment, guided it to successfully flatten the curve.

South Korea’s card payments market enjoys several incentives that will support its growth, GlobalData noted. Local banks incentivize card payments through a range of benefits, including cashback and discounts.

“Whilst the COVID-19 pandemic has affected the growth of card payments in the short-run, it will grow at a robust pace over the next four years, supported by the economic recovery and government incentives,” said Nikhil Reddy, payment senior analyst, GlobalData.

Credit cards remain the preferred card type in South Korea, accounting for 78.7% of card payments value in 2021. The preference is thanks to the reward benefits offered.

The government has also taken various measures to push card payments. In January, the government announced new tax benefits on credit card spending, allowing customers to claim additional tax deductions up to $918.81 (KRW1m) on taxable income if they increase credit card spending by 5% in 2021 compared to the previous year.

Officials also launched a subsidy scheme in June allowing credit cardholders to receive cashback on credit card spending in the form of points.

Advertise

Advertise