Southeast Asia’s neobank market to grow 50% in 2021

Funding and winding down of the pandemic’s impact on the economy will push this market.

Southeast Asia’s neobanking market is expected to grow by 50% in 2021, according to analysts from Singapore-based firm fintech services provider UnaFinancial. APAC-wide, the market will grow by 24%.

Higher funding and resumption of neobanks’ plans following disruptions due to the pandemic will push more digital-only banks to debut or clinch licenses this year, the study said.

Whilst the pandemic was noted to have slowed the development of digital-only banks in 2020, it has created strong potential for the segment moving forward, UnaFinancial said, with one of the factors contributing to this emerging growth being the delayed entry of new players last year.

“In January 2020, 21 companies applied for digital banking licenses in Singapore, and 4 companies did so in Malaysia. However, the pandemic disrupted these plans: in Singapore, only 4 licenses were issued, and in Malaysia, the licensing process was completely suspended and moved to 2021,” the study read.

More licenses were approved and more neobanks debuted by end-2020. Accordingly, five neobanks had already entered the South and Southeast Asian markets, with at least 10 companies following them in 2021. This marks the resumption of the neobanks development in the foreseeable future, UnaFinancial said in the study.

“The demand for online banking services among the population has also contributed to the growth of neobanking. Despite the general cautiousness, online banking saw a rise in popularity due to lockdown restrictions and remote work,” the study read.

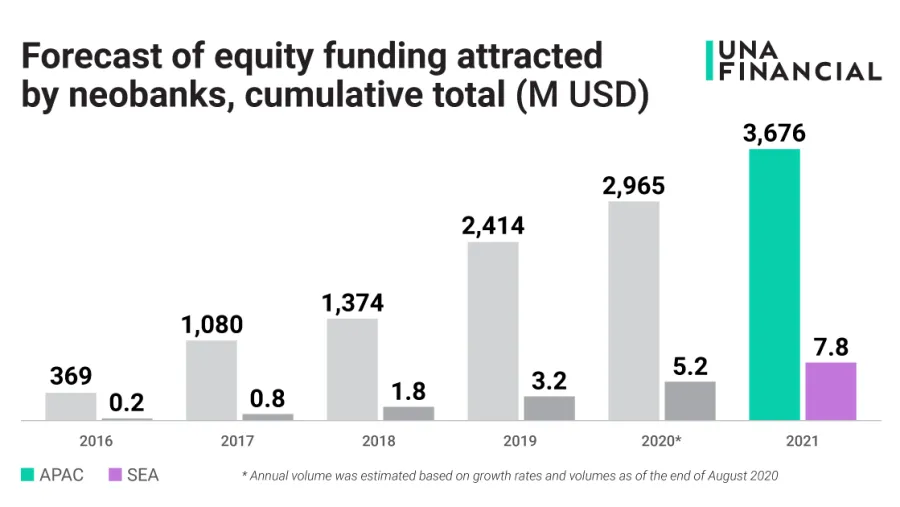

Following this upward trend, funding of neobanks in APAC countries in 2020 also rose by 22.8% compared to 2019.

Based on this, UnaFinancial said that it has estimated the growth of neobanks funding in 2021, and expects the market is expected to grow by 24% in APAC, and by 50% in SEA.

In SEA, the development of the segment will be led by Indonesia, Singapore, Malaysia, and the Philippines; while in South Asia, the leading country will be India.

Advertise

Advertise