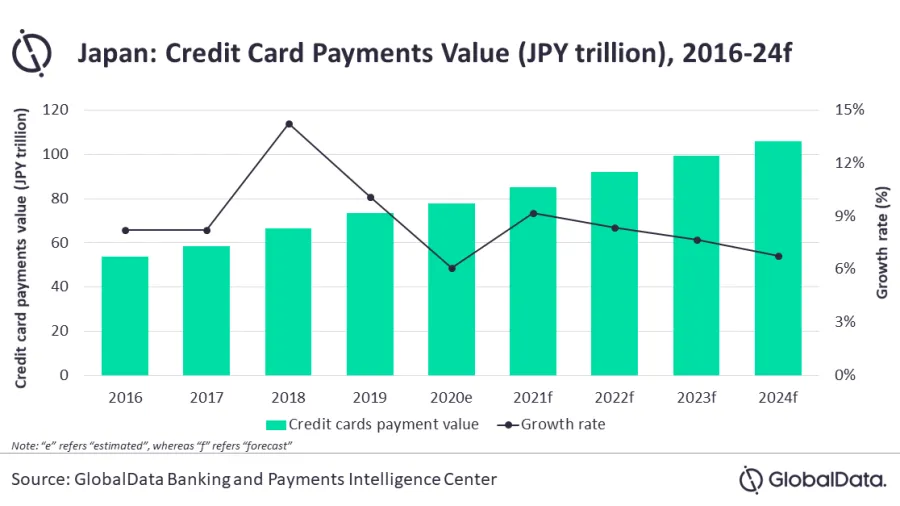

Chart of the Week: Japan’s credit card payments to grow 9.2% in 2021

Easing of restrictions, government support, and the Olympics will support growth.

The value of Japan’s credit card payments is estimated to grow by 9.2% in 2021, on the back of the easing of government restrictions, according to data and analytics firm GlobalData.

The credit card payments market in the country is forecast to register a compound annual growth rate (CAGR) of 7.6% to reach almost $1.023t (JPY105.9t) in 2024.

“Credit card adoption is high in Japan. Government initiatives to promote electronic payments coupled with growing usage of contactless cards for low value transactions will drive growth of credit card payments over the next five years,” says Nikhil Reddy, payments senior analyst at GlobalData.

Reddy notes that the government’s push for electronic payments and rising adoption of contactless payments will further push credit card usage in the country. To stimulate consumption following the COVID-19 pandemic, Japan has launched the ‘My Na Point’ reward program in September 2020 and recently ended in March this year. It offered consumers reward points up to JPY5,000 or$48.4 on purchases made using digital payments such as debit card, credit card and prepaid card.

Demand for touchless payment options will also drive the rise of card payments in Japan. A survey by American Express released in November 2020 found that 77.4% of respondents increased their use of contactless credit card payments whilst 75.8% of respondents indicated that they will continue to use contactless credit cards even after the pandemic.

“Japan has a highly evolved credit card market with each individual holding more than two cards,” Reddy said. “Pricing benefits and wider merchant acceptance are driving credit card usage in the country. In addition, most debit cards do not support e-commerce payments, which is also helping credit cards growth.”

The upcoming Olympics in August is also expected to provide an impetus to the payments industry, Reddy added.

Advertise

Advertise