Which Asian transaction bank really understands their customers?

By Martin SmithUnderstanding the Customer is a key metric in Asian Transactional Banking Markets, and is influenced by a growing number of product and service attributes. But how well do Asian Banks really understand their customers?

East & Partners Asian Institutional Transaction Banking Report presents the findings of thousands of in depth interviews with CFO’s and treasurers of the top 1000 institutions by revenue across ten Asian countries.

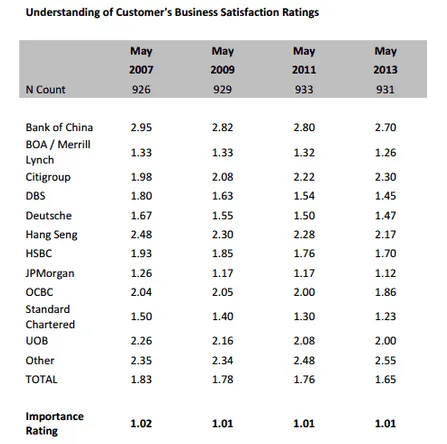

The report unveils a wide array of eye opening trends that may not necessarily be expected or acknowledged, but have continued to strengthen since the report’s inception in 2004. On a scale of 1 (satisfied) to 5 (dissatisfied) Institutional Businesses in Asia believe JP Morgan, Standard Chartered and Bank of America/Merril Lynch understand their business better than any other bank.

JP Morgan achieved the highest rating of 1.12, followed by StanChart (1.23) and BOA/ML (1.26). The absence of HSBC and Citigroup from the top three ranking is notable, given their places alongside StanChart as the ‘Big Three’ in Asian Transaction Banking. Citigroup is one of the only transaction bankers to record falling customer understanding satisfaction levels since 2007, dropping 32 points from 1.98 to 2.30.

In comparison, Citi’s main competitors have made large strides in this area, particularly DBS (1.45) and UOB (2.00) who have risen over 30 points over the same time period. The difficulties associated with truly understanding customer’s transaction banking business arise in many areas, including the ability to keep pace with constantly evolving technology, the overall strength of the relationship, the number of customers a relationship manager manages and overcoming unfamiliarity with the business the customer is operating within.

Understanding the customer is a pressing concern for transaction bankers operating within such a highly competitive environment - if you do not genuinely understand the issues facing your customers, then put simply, you will lose out to competitors who do. Although East & Partner’s research suggests Transaction Banking customers in Asia rarely react to competitive propositioning from other banks, more customers are banking away from their primary provider and shopping around to achieve the simplest solution or best value.

A strong understanding of your customers underlying issues and needs leads to more accurate service and product delivery, in addition to more cross sell opportunities.

This alone is suggested to reduce customer churn from a primary and secondary product and service provider perspective. Although wallet share and market share are preferred gauges of Transaction Banking success in Asia, ignoring mind share altogether is cautioned.

Taking relationship managers sole focus away from the provision of a product or service delivery to customers, and uncovering what issues their customers are actually trying to overcome allows for a more streamlined marketing approach, resulting in organic market share and wallet share gains.

Advertise

Advertise