Check out BNP Paribas' new integrated platform for its corporate clients

CENTRIC launched first in Hong Kong and Singapore.

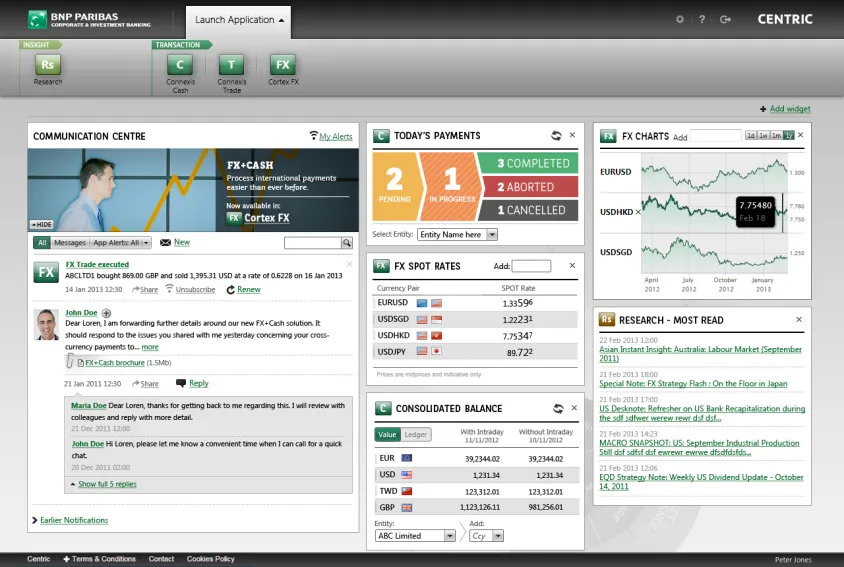

BNP Paribas recently launched CENTRIC - its integrated, multi-product, application-based platform. The bank launched CENTRIC first in Hong Kong and Singapore before rolling it out in Asia Pacific.

The new platform aims to provide corporate clients with seamless access to a comprehensive range of electronic transaction banking, FX and research products and services.

Asian Banking and Finance interviewed Mr Pierre Veyres, Global Head of Global Transaction Banking at BNP Paribas, to learn more about the new tool.

ABF: What spurred the launch of this new tool in platform?

The global financial crisis has left its mark on the whole eco-system, including on corporate’s behaviour as well : From a treasury point of view, corporates need to address critical mass whilst dealing with market-specific abilities and prudent liquidity management.

Moreover the shift in the decision-making process from global to regional, notably in Asia Pacific, coupled with the complex environment in which most of the corporates operate, means corporate treasurers expect control and visibility.

Although most companies have moved beyond crisis-management mode and towards growth, the discipline of optimizing working capital and drive cash remains a key component in their strategies, operational efficiency being an important driver.

We are therefore offering a seamless multi-products, application based, platform configured not only to optimize efficiency, but help corporate treasurers do business

ABF: What's new about it for BNP Paribas and your clients?

BNP Paribas offers an integrated platform connecting its award winning products and solutions, supporting financing, payment and currency hedging.

With this platform, our corporate clients will now be able to customize their own interactions, flows of information, with their needs and activities. They will be able to interact in real-time with the Bank’s experts, notably via client-oriented widgets, networking and communication tools.

Whether a client is looking for cash management services, trade finance solutions or currency hedging, CENTRIC has been designed to offer clients increased choice and control of all their treasury business operations from the convenience of a single platform. Also, Centric offers the latest research and market commentaries.

ABF: What do you hope to achieve with this initiative?

The CENTRIC launch represents a major step of our digital journey with the provision of an integrated and innovative platform, solutions and information to our corporate client base.

The corporate market is a key pillar to achieving growth in the APAC region and thanks to CENTRIC we keep expanding with the ambition to become the bank of choice for Local Corp & MNC Treasuries in APAC.

Available from today in APAC, CENTRIC will also be expanding geographically into the other regions. Meanwhile we will also be regularly adding new features to fit our client needs as early as the second half of 2013.

ABF: Anything else you would like to highlight?

CENTRIC front-end will also progressively propose bundled products, the first of its kind being FX+Cash.

FX+Cash is a new cross-currency solution for both payments and collections. It was designed to provide all-in-one FX and Cash services (FX and Cash operations embedded into one single transaction). Our corporate clients will be able to use this bundle for all transaction types such as international payroll, pensions, import and export transactions, inter-company flows. BNP Paribas offers thru CENTRIC around 150 pairs of currencies.

Advertise

Advertise