What you need to know about the new HSBC Wealth Dashboard

Cash, investment holdings displayed in real-time.

HSBC recently launched the Wealth Dashboard, its enhanced Personal Internet Banking platform that consolidates each customer's entire wealth holdings – including cash deposits and investments – onto one single screen online, saving the time and effort to click on different accounts.

We interviewed Mr Paul Arrowsmith, Head of Retail Banking & Wealth Management, HSBC Singapore, to learn more about the new plat

ABF: What spurred the launch of this new platform?

Usage of online banking among HSBC customers in Singapore has seen an uptrend in the last two years with annual growth rate of 18.4% from March 2011 to March 2013 among HSBC Premier customers who are registered on Personal Internet Banking.

With increasing number of customers embracing online banking for their day-to-day transactions, the new HSBC Wealth Dashboard is a timely and value-added proposition which takes them a step further in making sense of their assets more easily.

Customers have told us that the portal has brought about greater convenience as they are now able to navigate and manage their investments much more seamlessly on a one-stop-shop portal. With easier and faster access to information about their assets, they are now able to engage in more meaningful and in-depth conversations with our Relationship Managers in their wealth planning.

HSBC Premier is a global priority banking proposition that supports the needs of the international mass affluent through personalised retail banking and wealth management products and services, serving customers with Total Relationship Balance of S$200,000 or more.

ABF: What's new about it for HSBC and your customers?

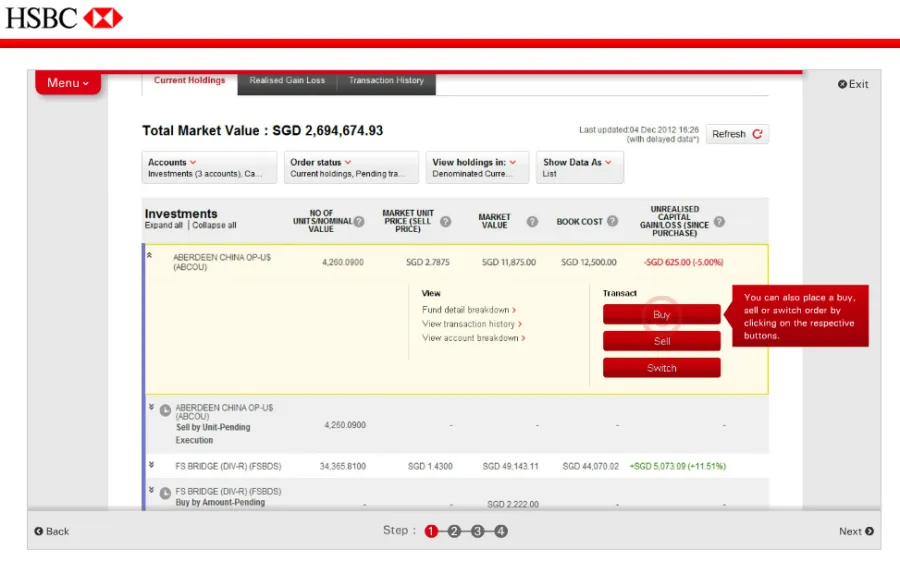

The new HSBC Wealth Dashboard is an enhanced Personal Internet Banking platform to enable our customers to view their total wealth holdings. This new portal will display cash and investment holdings in real-time as a single, consolidated view online, saving customers the time and effort of having to access different accounts. It will also allow ‘timely execution of deals’ by customers and give them more control over their wealth portfolios.

This holistic view – neatly classified by asset class – allows customers to see, at one glance on screen, their total assets with the bank, making it easier for them to manage and monitor their cash deposits and investment portfolios as well as track and analyse the performance of their holdings more conveniently and efficiently, anytime and anywhere.

Other interesting features include allowing customers to easily track the current market value of their investments against purchase price to see if their assets have appreciated or depreciated; display their foreign currency holdings in Singdollars; view the realised gains or losses if they have sold or redeemed their investments; place time deposits and carry out trading of unit trusts online; and retrieve history of all investment transactions of the last two years in chronological order.

Available to all HSBC retail customers in Singapore, the Wealth Dashboard is the bank’s new one-stop e-banking and wealth management solution which provides a simple, holistic display of one’s entire wealth portfolio invested with HSBC Singapore across cash deposits, unit trusts, bonds, dual currency products and structured investments such as structured products and equity-linked notes.

ABF: What do you hope to achieve with this initiative?

The new HSBC Wealth Dashboard is all about transforming our retail banking and wealth management capabilities by putting customers at the heart of our business.

As we expand and enhance our range of banking services and wealth solutions to address the long term needs of our customers, Wealth Dashboard is a good example of leveraging technology and innovation to provide customers with a secure and relevant tool for a simpler and more meaningful e-banking experience.

We are very happy to make available to our retail customers a best-in-breed online banking solution to help manage their wealth, bringing online banking to a new level of experience and innovation

ABF: Anything else you'd like to add?

We are a step ahead of our competitors to introduce what I believe is a very progressive and customer-centric wealth management tool in the Singapore retail banking market. The many useful features of Wealth Dashboard will enhance the online banking experience of our customers by giving them a bird’s eye view of their wealth holdings with us, across various asset classes.

As its name aptly describes, the Wealth Dashboard puts our customers in the driver’s seat, giving them the information, advice and tools to actively monitor and manage their investment portfolio.

Wealth Dashboard is available today to all retail customers with a savings, current or investment account with HSBC Singapore. Customers are required to have registered with Personal Internet Banking in order to access Wealth Dashboard.

Click here to view a video introducing the new Wealth Dashboard; or visit this site for an interactive online demonstration which will take you step-by-step through the key features of the portal.

Advertise

Advertise