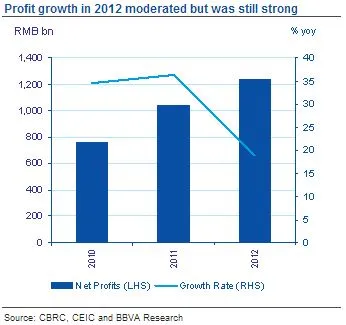

China banks' 2012 profit growth down to 19% from a record 39% in the previous year

But results are still impressive, thanks to better NPLs.

According to BBVA, the China Banking Regulatory Commission (CBRC) released its annual set of banking indicators last Friday, showing overall profit growth of 19% for the banking system, notwithstanding headwinds from the economic slowdown and narrowing interest margins.

Here's more from BBVA:

The indicators are for the overall banking system, consisting of both listed and non-listed banks; full-year financial results for the listed banks will be released at end-March.

While the profit growth was down from a record 39% in the previous year, it still exceeded our expectations (about 9%) by a wide margin due to better-than-expected NPLs.

The indicators also show that liquidity remained adequate and that capital increased slightly following the implementation of capital replenishment plans by several banks.

Asset quality deteriorated somewhat (albeit less than expected), a trend that is likely to continue over the next couple of years due to the recent rapid pace of credit growth and ongoing downshift in GDP growth.

Given an expected further tightening of interest margins and regulations, we maintain our projection of slowing profit growth in the coming years.

The overall loan-to-deposit ratio edged up to 65.3% at end-2012, from 64.8% the previous year. Banking liquidity remained adequate as the PBoC offset tighter financial conditions from capital outflows through cuts in the RRR and expansionary open market operations.

Meanwhile, the overall capital adequacy ratio increased to 10.6% from 10.2% during the same period, on the successful implementation of capital replenishment plans, as well as reductions in dividend payout ratios of a few banks.

Advertise

Advertise