You should know about the 'Three-Horizon' growth strategy for Islamic banks

By Adil AhmadIt is very clear that Islamic banking is now an established industry with high growth prospects. Asia is and will continue to be a key geographical area for this industry, whether it is South East Asia, South Asia or the Middle East.

As the Islamic industry grows, and new players enter the arena, these players will need to adapt best practices developed and successfully utilised in the non-Islamic world - while of course strictly adhering to Shariah compliant principles.

One such essential best practice is the creation of well thought out, documented and executable strategic growth plans. Every financial organisation, both Islamic and non-Islamic, consists of a portfolio of businesses. Each individual business has a life cycle of initial launch, growth, maturity and eventual decline, and for an organisation to be successful over long periods of time it must have at all times a combination of businesses, some of which are in the decline phase while others are in the growth phase or in the maturity phase and so on. This will only happen if the organisation has a well developed strategy.

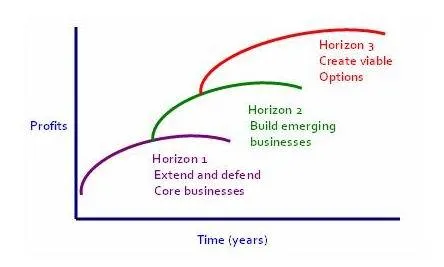

One of the best frameworks for such a strategy is the ‘Three Horizons Strategy’ developed by the consultancy firm McKinsey. This breaks down the business creation process into three stages: (See Figure 1.)

Horizon 1 businesses are the heart of the organisation. These provide the vast majority of the profits. Horizon2 consists of the emergent businesses. Many of these already have customers and are generating revenue, but require substantial additional investment before they can generate profits similar to the Horizon 1 businesses. Horizon 3 contains the seeds for the future. These are the businesses that are being researched/investigated and will be launched in the future if the results of the research are positive. In summary, each Horizon 2 business was once a Horizon 3 business and each Horizon 1 business was once a Horizon 2 business. An organisation which is seeking to be successful in the long run has to ensure that its business pipeline contains a proper balance of businesses in each Horizon. It needs to extend and defend its existing Horizon 1 businesses and simultaneously build new ones by investing a part of the profits generated by the Horizon 1 businesses.

The Three Horizons strategy is intuitively logical and straightforward. But, many leaders neglect Horizon 2 and Horizon 3 businesses because they become pre-occupied with running their Horizon 1 businesses. They delay the financial and managerial investment in Horizon 2 and 3 businesses until the Horizon 1 businesses go into decline and become less profitable. By then, the challenges to developing future businesses is multiplied as there is both less time and reduced profits.

At Kuwait International Bank (‘KIB’), when I took over as CEO we successfully utilised the Three Horizon strategy to convert the existing conventional real estate bank into a full service Islamic commercial bank. KIB’s initial Horizons were as follows:

Horizon 1:

- Defend and expand the existing real estate financing business

- Obtain regulatory approvals to convert bank into a full service Islamic bank

- Convert existing operations to Shariah compliant (assets and liabilities; core banking system; staff training etc)

Horizon 2:

- Grow the niche real estate business into a full fledged corporate banking business

- Establish a broad based retail banking business

Horizon 3:

- Establish a funds management business

- Establish a brokerage business

By the time I left KIB we had successfully completed Horizon 1 and our other two horizons had moved up one step. Our new Horizon 3 was international expansion.

Advertise

Advertise