Hong Kong banks' system loans up 9.6% in 2012

Thanks to trade finance and China-related lending.

According to Barclays, the HKMA's December monetary statistics again showed strong deposit growth, supporting its view that increasingly abundant liquidity conditions coupled with slower loan demand will pressure volume and margin going into 2013.

Among the local Hong Kong banks, Barclays prefers BOCHK which is best capitalised and most geared to any potential positive offshore RMB developments.

Here's more from Barclays:

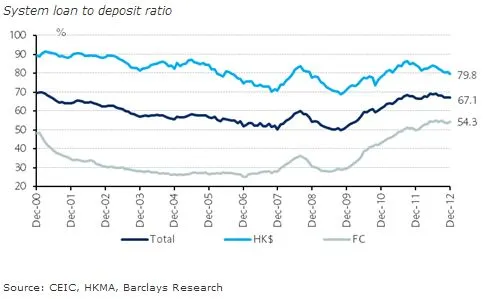

Abundant liquidity: In 2012, system loans rose by 9.6% driven by trade finance and China-related lending, while deposits similarly rose by 9.3%, although deposit growth occurred predominantly in 4Q12 (+4.5% q/q) after further quantitative easing in the US led to capital inflows into Hong Kong. System loan to deposit ratio was 67% at year end (after peaking at 69% in June 2012).

In December, HK$ deposit growth was again strong (+1.9% m/m) while HK$ loan growth lagged (+0.8% m/m), resulting in a fall in HK$ loan to deposit ratio to 79.8% (Nov: 80.7%).

There was a notable positive mix shift in HK$ deposits, as HK$ demand and savings deposits rose by 3.6% m/m, while time deposits contracted by 0.8% m/m, as the banks lowered HK$ time deposit rates.

System loans rose 1.5% m/m, again driven by loans for use outside Hong Kong (mainly China-related) which now accounts for 28% of total loans (vs 21% 2 years ago).

Meanwhile, system deposits rose 1.8% m/m. HK$ deposits increased by 2.0% m/m, led by growth in lower costing demand deposits.

Loan growth in 4Q driven by loans to financial companies, housing, personal and China: Based on the HKMA's quarterly loan disclosure by sector, loan growth of 2.5% q/q was driven mainly by loans to the financial sector (+9.5% q/q), housing (+3.1% q/q), other personal loans (+8.2%) and loans for use overseas (+3.7% q/q).

On the other hand, trade finance contracted by 7.7% q/q reversing part of the 19% growth in 9M12. We believe the contraction of trade finance lending was due to weaker demand for short term cross-border trade loans given the looser monetary conditions in China in 4Q.

Advertise

Advertise