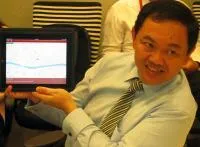

OCBC offers iPad banking and trading applications

OCBC becoming the first financial institution to launch applications for one of Apple’s latest gadget, continues to pull on technological innovation for its clients and investors.

Oversea-Chinese Banking Corporation Limited (OCBC) and its subsidiary, OCBC Securities Pte Ltd (OSPL), on Thursday said they will be offering banking and securities trading services on iPad with effect from 23 July 2010. This makes OCBC the first financial institution to introduce iPad financial applications, according to an OCBC statement.

OCBC Mobile Banking for iPad Mr Patrick Chew, OCBC Bank’s Head of Delivery, Global Consumer Financial Services said, “The need to evolve our banking channels with devices like the iPad is important as customers’ expectations grow in tandem with what technology can offer. Consumers expect convenience and ease when they go about with the basic necessities of life, especially when it comes to services that they use on a regular basis, such as banking.”

According to the release, some of the functions that OCBC customers can enjoy are: view 20 of their favourite stocks or market indices at a glance and trade into 14 key local and foreign securities exchanges, among many others.

iOCBC TradeMobile for iPad Mr Hui Yew Ping, Managing Director of OCBC Securities Pte Ltd shared, “Since the launch of our iOCBC TradeMobile iPhone application in May this year, there has been close to 10,000 downloads. This shows that investors are increasingly tech-savvy and want to leverage on technology to make investing faster and more accessible.”

OCBC Bank was the first to introduce mobile phone banking on StarHub i-mode in 2005, the first to launch banking services on iPhone in 2008, and also the first to introduce an iPhone trading application, iOCBC TradeMobile, in Singapore in 2010.

“Following the increased usage of OCBC Mobile Banking when it was made available on iPhones in 2008, the iPad’s responsive high-resolution multi-touch display has allowed us to create a banking application that will enable users to have an even better banking experience,” Mr Chew added.

The applications will be made available through the Apple App Store in Singapore. The new service offerings are in line with OCBC Bank’s ongoing strategy to proactively leverage on technological innovation to make it easier for our customers and investors to perform retail banking and securities trading transactions, anytime and anywhere.

The OCBC iPad banking application, however, is expected to continue evolving after Thursday’s launch, with new banking services added progressively.

Existing OCBC Bank internet banking and mobile banking customers, and iOCBC TradeMobile customers can use their respective IDs and Passwords to access their banking or securities trading accounts via their iPads starting 23 July.

Advertise

Advertise