CIMB Principal gets a go-ahead for its private retirement schemes

The schemes aim to complement the Employees Provident Fund savings by employees.

In a release, CIMB-Principal Asset Management Berhad announced that the company has received regulatory approval from the Securities Commission Malaysia (SC) for its private retirement schemes - CIMB-Principal PRS Plus and CIMB Islamic PRS Plus.

In this regard, Campbell Tupling, Chief Executive of CIMB-Principal commented, “We believe CIMB-Principal’s PRS is one of the most comprehensive solutions offered in the market, as it has two separate approved conventional and Islamic schemes. Retirement planning is now more convenient and accessible to individuals who wish to start a PRS for themselves with CIMB-Principal.”

With the green light given, CIMB-Principal is rolling out its PRS with the aim of complementing Employees Provident Fund (EPF) savings by employees, and also to help individuals who do not contribute to EPF for their retirement.

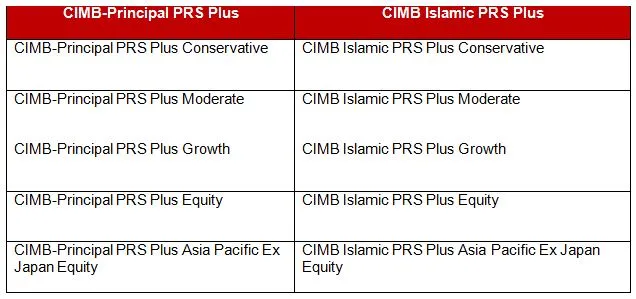

Click the photo to see the approved funds under CIMB-Principal’s PRS.

As an approved provider, CIMB-Principal hopes to be a prominent market player in tandem with the anticipated growth of the PRS industry. This is supported by the view that PRS will soon gain importance apart from EPF savings and insurance schemes in Malaysia’s multi-pillar retirement scheme framework.

“In its infant stage, public awareness and education are important to ensure that the working population is well-informed and familiar with PRS. Our focus will be on educating the general public the benefits of PRS savings for retirement via outreach programmes and sales distribution channels. CIMB-Principal will also be working closely with corporates to ensure that PRS solutions are adopted as part of their compensation and benefit package in order to attract and retain talent,” added Tupling.

Advertise

Advertise