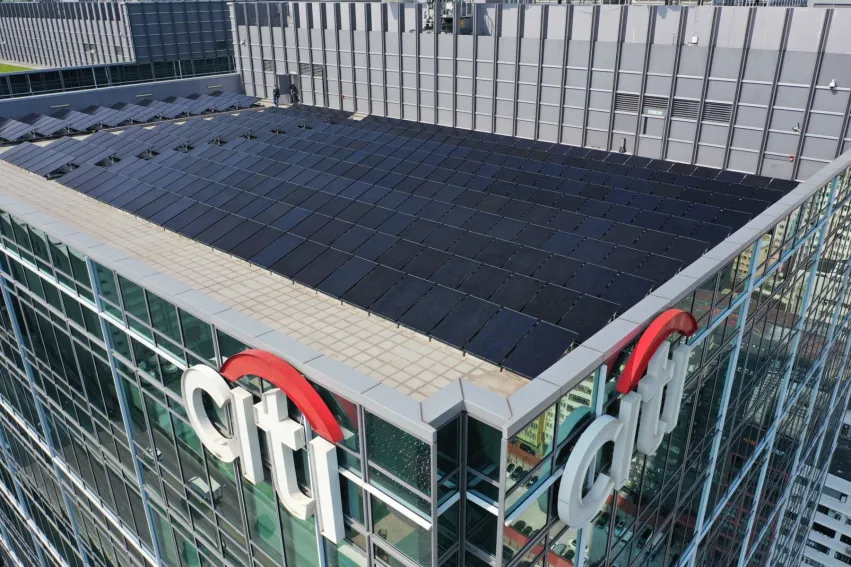

Citi Hong Kong installs 360 solar panels on Citi Tower

In 2020, the bank reached its goal to source 100% renewable energy to power local operations.

Citi has installed a hybrid electrical and thermal renewable energy system on the rooftop of Citi Tower in Kowloon East, Hong Kong.

In a press release, the bank shared that the 360 solar panels is expected to produce 85,337 kilowatt hours of renewable electricity. This is equivalent to the annual energy consumption of 20 households, and will contribute to a cost saving of approximately 4% of the building’s annual power consumption.

The rooftop installation also includes a wind turbine, which generates electricity on-site for local use.

Under the CLP Renewable Energy Feed-in Tariff (FiT) Scheme, Citi will receive FiT payments for connecting the system to CLP’s electricity grid.

“We are delighted to be working with our longstanding partner CLP on furthering our sustainability commitments. The Feed-in Tariff Scheme is an important initiative to promote wider use of renewable energy in Hong Kong. We are proud to be contributing to this effort, which is in line with our group-wide strategy to reduce the environmental footprint of our facilities around the world,” said Angel Ng, CEO for Citi Hong Kong and Macau.

The move is in line with the group’s commitment to net zero greenhouse gas emissions by 2050, as announced by Citi CEO Jane Fraser earlier this March.

In Hong Kong, Citi said that it has already reached its goal to source 100% renewable electricity to power its operations in 2020.

The bank plans to publish a Net Zero by 2050 plan next year, which will include emissions reduction targets for carbon-intensive sectors that also have low-carbon transition opportunities.

For Citi’s own operations, the goal is to achieve net zero greenhouse gas (GHG) emissions by 2030. Since 2005, Citi has reportedly reduced 3,600 gigawatt-hours of energy use and avoided 2.4 million metric tons of CO2 equivalent—this equates to the GHG emissions of over half a million cars on the road for a year.

The bank said that it also plans to actively engage clients to help them achieve their own transitions to net zero.

“Net zero means rethinking our business and helping our clients rethink theirs. We believe that global financial institutions like Citi have the opportunity—and responsibility—to play a leading role in accelerating the transition to a net zero economy and deliver on the promise of the Paris Agreement,” ” Angel said, adding that their track record in sustainable finance will enable the bank to support clients with new ways of creating financial value that has environmental social benefits.

From 2014 to 2019, Citi financed and facilitated US$164b in low-carbon solutions and last year committed to an additional US$250b in environmental transactions by 2025.

Advertise

Advertise