Tonik launches neobank in the Philippines

It offers up to 6% interest rate per annum.

Tonik, touted as Southeaset Asia’s first digital-only bank, has officially launched a neobank in the Philippines.

To start, Tonik is offering deposit interest rates of up to 6% per annum.

The bank features what it calls Stash and Group Stash features as well as traditional term deposits.

“We started Tonik because we were fed up with how traditional banks mistreat their customers. The fact that 70% of the Filipinos remain unbanked shows that the tedious onboarding process of traditional banks and their ridiculously low interest rates do nothing to satisfy the needs of the consumers,” said Tonik founder and CEO Greg Krasnov.

Tonik Digital Bank president Long Pineda said that Tonik aims to become the first bank brand with “a sense of humor and personality” in the Philippines.

“Sadly, traditional banks have completely forgotten how to listen to their customer. So, we are on a quest to become the first bank brand in the Philippines with a sense of humor and an actual personality that consumers can relate to,” Pineda said.

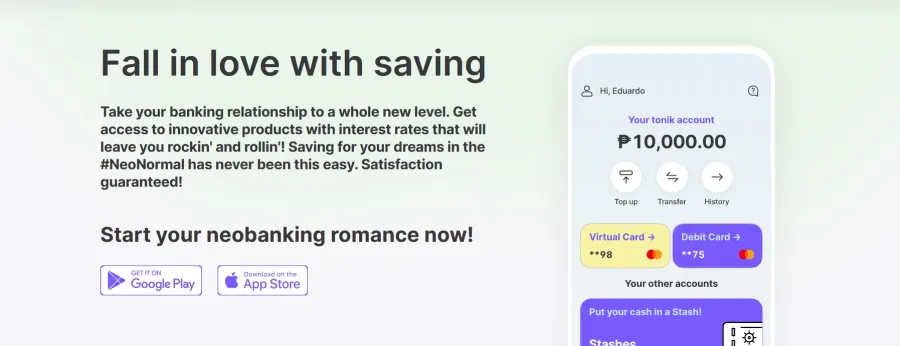

“Our mission is to trigger a wave of #NeoBankingRomance in the Philippines. We expect our proposition for the #NeoNormal to resonate particularly strongly with the ‘digital natives’ in the Philippines, who constitute most of the population,” Pineda added.

Tonik makes use of a cloud-based solution powered by Mastercard, Finastra, and Amazon Web Services. Customers can open a fully functional banking account in under five minutes, using only the Tonik App, an ID and a selfie. They can easily top up their Tonik account can be easily topped up in many convenient ways, including interbank, debit card, or in cash at close to 10,000 retail agents across the country.

Also immediately upon onboarding, the customer is issued a virtual Mastercard debit card that can be used at a variety of e-merchants. The product offer will soon be expanded to include a physical debit card or take out an all-digital consumer loan.

Whilst aiming for a friendly and humorous personality, Tonik assures that it takes the security of the client’s funds and transactions on its systems seriously. Tonik is reportedly the first bank in the Philippines certified as compliant with PCIDSS, the global “gold standard” in payment card security.

Further, Tonik’s systems are also certified by CISA, the top authority in global IT security audits.

Advertise

Advertise