Chart of the Week: Singapore’s card payments market to grow 10.2% in 2021

Business reopenings and ongoing COVID vaccination program will support spending.

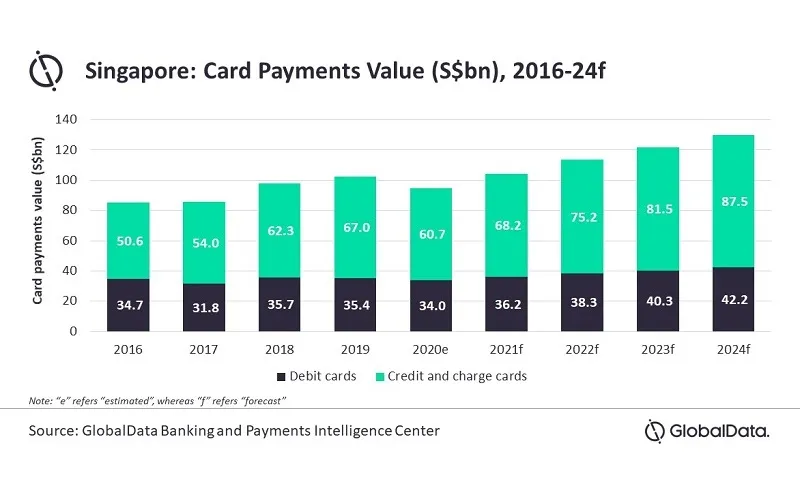

Singapore’s card payments market is set to rebound in 2021 after a decline in 2020 halted its growth rally for the past few years, reports data and analytics company GlobalData.

According to GlobalData’s Payment Cards Analytics, card payments in the Lion City are set to grow by 10.2% in 2021, thanks to the reopening of businesses, forecasted recovery in consumer spending, and the ongoing COVID-19 vaccination program.

Against this backdrop, the value of card payments is expected to register a compound annual growth rate (CAGR) of 8.2% between 2020 and 2024 and reach $96.5b (S$129.8b) in three years’ time.

The increase in consumer demand for credit, especially from the growing middle-class, helped the growth of credit and charge card transactions during the review period, notes Nikhil Reddy, banking and payments analyst at GlobalData.

“Singapore payment cards market is well developed with majority of the consumers having access to payment cards,” Reddy noted, adding that the ability to earn cashback and other rewards associated with credit cards make them the preferred card payment in the past years.

However, the economic slowdown and the travel restrictions amidst the COVID-19 pandemic forced individuals to spend prudently, which resulted in the reduced usage of payment cards in the short-term.

As a result, the value of credit and charge card payments registered a decline of 9.4% in 2020, higher compared to the 3.8% decline in debit cards.

With the revival of the economy, credit card usage is expected increase. According to GlobalData’s Payment Cards Analytics, the value of credit and charge card payments is forecasted to register a compound annual growth rate (CAGR) of 8.7% between 2021 and 2024 while debit cards will grow at a CAGR of 5.3% during the same period.

In terms of usage, credit and charge cards remain the most preferred card payments method in Singapore, accounting for 64.1% of the total card payments in 2020 whilst debit cards accounted for the remaining 35.9% share.

Advertise

Advertise