Olympics, improving economy to push Japan card payments up by 9.5%

Card payments in Japan are expected to reach $1.1t by 2024.

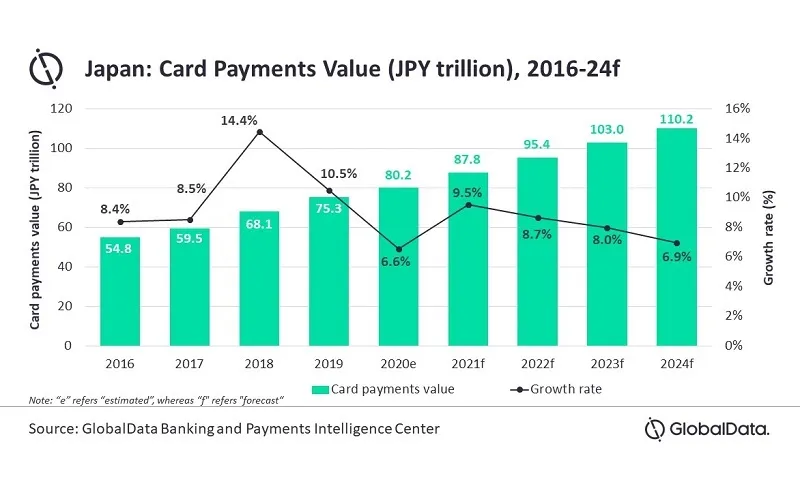

The improvement in consumer spending and the upcoming Summer Olympics are set to push Japan’s card payments to rise by 9.5% in 2021, forecasts data and analytics company GlobalData.

All signs point to a rebound in the use of the plastic for payments, with the reopening of the Japan’s economy, government measures encouraging electronic payments, the easing of travel restrictions, and the upcoming Tokyo Olympics.

“The upcoming Olympics and Paralympics slated for July and August 2021, respectively, are expected to provide an impetus to the country’s payments industry,” notes Kartik Challa, banking and payments senior analyst, GlobalData.

Overall, GlobalData expects card payments to register a compound annual growth rate (CAGR) of 8.3% between 2020 and 2024 and total $1.1t (JPY110.2t) in three years’ time.

“Whilst the Japan’s payment landscape has traditionally been dominated by cash, government initiatives to promote electronic payments and an improving payment infrastructure will drive the growth of the payment card market,” Challa noted.

Card use has already been given a massive push thanks to the local government’s reward program ‘My Na Point’ that was launched in September last year and just recently ended this March. It offered consumers reward points worth up to JPY5,000 ($48.4) on their purchases made using digital payments such as debit card, credit card and prepaid card.

Meanwhile, all the country’s major banks and payment participants are reportedly making their payment infrastructure compatible with foreign-issued cards and installing POS terminals at locations with high footfall, such as tourist attractions and supermarkets.

Card issuers are also noted to be working on pushing contactless adoption and encouraging consumers to shift away from cash. For instance, AEON Card, in collaboration Visa, plans to roll out around 10 million contactless cards by the end of 2021 and enable contactless feature in 100,000 cash registers across 16,700 stores including AEON, AEON MALL, Maruetsu, Welcia, and My Basket.

Advertise

Advertise